Tax Tips for Surviving Crypto Winter

TokenTax content follows strict guidelines for editorial accuracy and integrity. We do not accept money from third party sites, so we can give you the most unbiased and accurate information possible.

Refraining from selling can help avoid immediate tax implications in a crypto bear market. Holding onto assets means gains or losses remain unrealized, and if the market improves, the value may increase. However, it's essential to note that crypto-to-crypto trades are still considered taxable events.

If selling is necessary, prioritize selling long-term investments first. Profits from assets held for more than a year are taxed at more favorable long-term capital gains rates compared to short-term rates, which align with income tax rates. Investors can optimize their tax positions during challenging market conditions by carefully selecting which assets to sell.

In 2022, we found ourselves in a crypto bear market, a “crypto winter” precipitated by the Terra Luna collapse, which revealed the under-collateralized status of many lending projects.

While tax strategies won’t eliminate traders’ financial setbacks, they can mitigate the damage. Below, we’ve collected tips from our experts on how to be smart about taxes during a crypto bear market.

1. Hold—don't sell

If you have enough liquid assets on hand (a big if, we know), you can avoid taxes by simply not selling. Technically speaking, any gains or losses on assets under your control have not been realized, so if you can hold onto those assets, you don’t have anything to report—and you may still see those assets' value increase in the future. But remember: crypto-to-crypto trades are also taxable events.

2. Sell long-term investments first

If your financial situation requires you to sell assets, consider selling your long-term investments first. If you’ve held tokens for more than a year, any profits made from selling them will be taxed at the preferable long-term capital gains tax rates, rather than the short-term gains rate, which is the same as your income tax rate.

For example, imagine you have 20 ETH: 10 ETH you bought over a year ago for $1,100 and 10 that you bought recently for $1,100. If you sell 10 ETH now when ETH is trading at $1,500, you would have $4,000 of gains.

However, if you sell the 10 ETH that you bought recently, your gains will be taxed at the higher short-term capital gains rate (10%-37%), compared to the lower long-term rate (0%, 15%, or 20%) that would apply to your ETH purchased over a year ago. This is one more reason it’s important to keep track of your crypto transaction data.

3. Deduct losses from your ordinary income

If you’ve earned money from salaries or wages, from payment for goods or services, or from mining or staking crypto, you’ll have ordinary income to report on your taxes. You can use crypto capital losses to deduct up to $3,000 per year from this ordinary income.

4. Tax loss harvest

If you’ve had capital gains in your portfolio (either in crypto or in traditional investments), you can strategically sell assets held at a loss in order to offset those gains and reduce your taxes. This practice is called crypto tax loss harvesting. If your realized losses are large enough, you may be able to offset all your gains from a given year, and even carry the losses forward to future tax years.

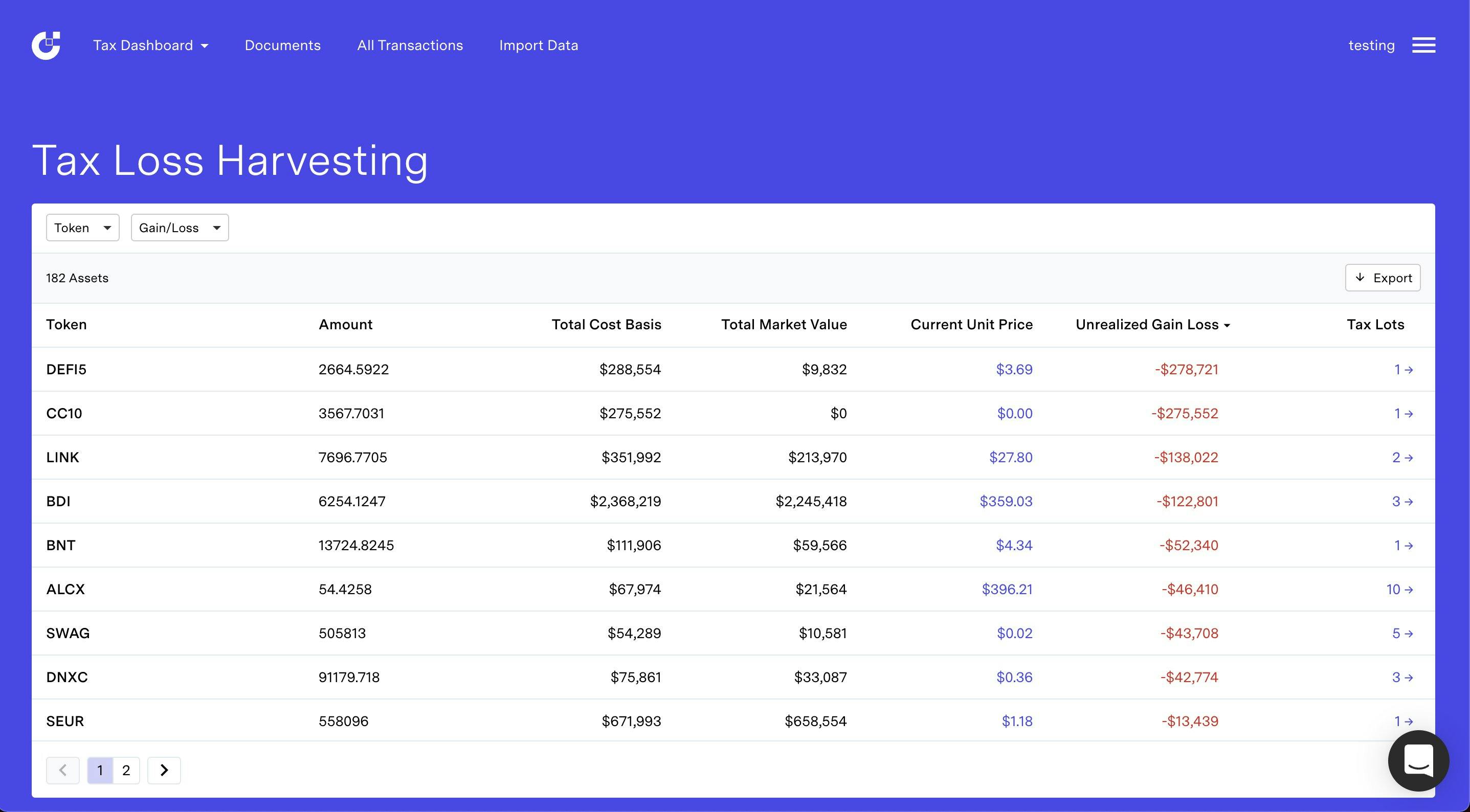

Crypto tax software can help you and your accountant determine the best opportunities for tax loss harvesting. For example, TokenTax’s Tax Loss Harvesting Dashboard, which is pictured below, keeps a real-time record of assets held at a loss throughout your wallets and accounts.

5. Carry forward losses

As mentioned above, if your losses exceed your gains in a given tax year, your losses will automatically carry forward for an indefinite number of future tax years. While this may not put more money in your pocket this year, you can take some solace in the fact that some of your future gains are already offset.

6. Talk to your crypto tax accountant about worthless securities

If you suffered losses from something like the Terra Luna collapse, or have become unable to access your assets because of a platform’s insolvency, you may be able to write off those assets as worthless securities.

However, be aware: among crypto tax accountants, there is not consensus that crypto assets would be eligible for this provision. Although many tokens seem similar to securities, officially they have not been classified as such by the SEC. Talk to your accountant before executing this strategy.

Frequently asked questions for surviving crypto winter

Here are answers to frequently asked questions about surviving a crypto bear market.

Why is holding onto crypto assets during a bear market suggested, and how does it impact taxes?

Holding onto crypto assets during a bear market can help avoid immediate tax implications as gains or losses remain unrealized. This strategy aims to mitigate potential losses, and technically, no tax reporting is required until assets are sold. However, it's important to note that crypto-to-crypto trades are still considered taxable events.

Why should long-term investments be prioritized for selling during a bear market, and how does it affect tax rates?

Selling long-term investments first during a bear market is recommended because profits from assets held for more than a year are taxed at more favorable long-term capital gains rates. This contrasts with short-term gains, which are taxed at higher rates equivalent to income tax rates. By selling long-term investments, investors can optimize their tax positions and potentially reduce their overall tax liability.

How can crypto losses be used to offset ordinary income, and what is the maximum deduction allowed?

Crypto losses can be deducted from ordinary income, including salaries, wages, and income from goods, services, mining, or staking crypto. Investors can use crypto capital losses to deduct up to $3,000 per year from their ordinary income if their tax filing status is single or married filing jointly ($1,500 for married filing separately). This strategy helps minimize tax liability by leveraging losses incurred in the crypto market against other forms of income.

To stay up to date on the latest, follow TokenTax on Twitter @tokentax.