Guide to Crypto Mining Taxes for 2024

TokenTax content follows strict guidelines for editorial accuracy and integrity. We do not accept money from third party sites, so we can give you the most unbiased and accurate information possible.

Cryptocurrency mining rewards are taxed as income upon receipt. US-based crypto miners can anticipate paying crypto mining tax on both income from rewards and capital gains upon the sale of coins from mining activity.

Crypto mining tax implications differ between hobbyists and those professionally mining as a business. Those who mine crypto under a business may be eligible for certain tax deductions.

What is crypto mining?

Crypto mining is a means by which Bitcoin and other cryptocurrencies are generated and through which new blockchain transactions are verified. Crypto mining involves large and decentralized networks of computers that act to verify and secure blockchains.

In exchange for their contributions, cryptocurrency miners receive new tokens as a reward. Miners help to maintain and secure blockchains by providing processing power, and the blockchains award coins as an incentive.

Do you pay taxes on mining?

As noted above US-based crypto miners of Bitcoin, Ethereum, or other cryptocurrencies can anticipate paying taxes on crypto mining as:

Regular income at the time of mining.

Crypto capital gains when the mined tokens are disposed of at a later date.

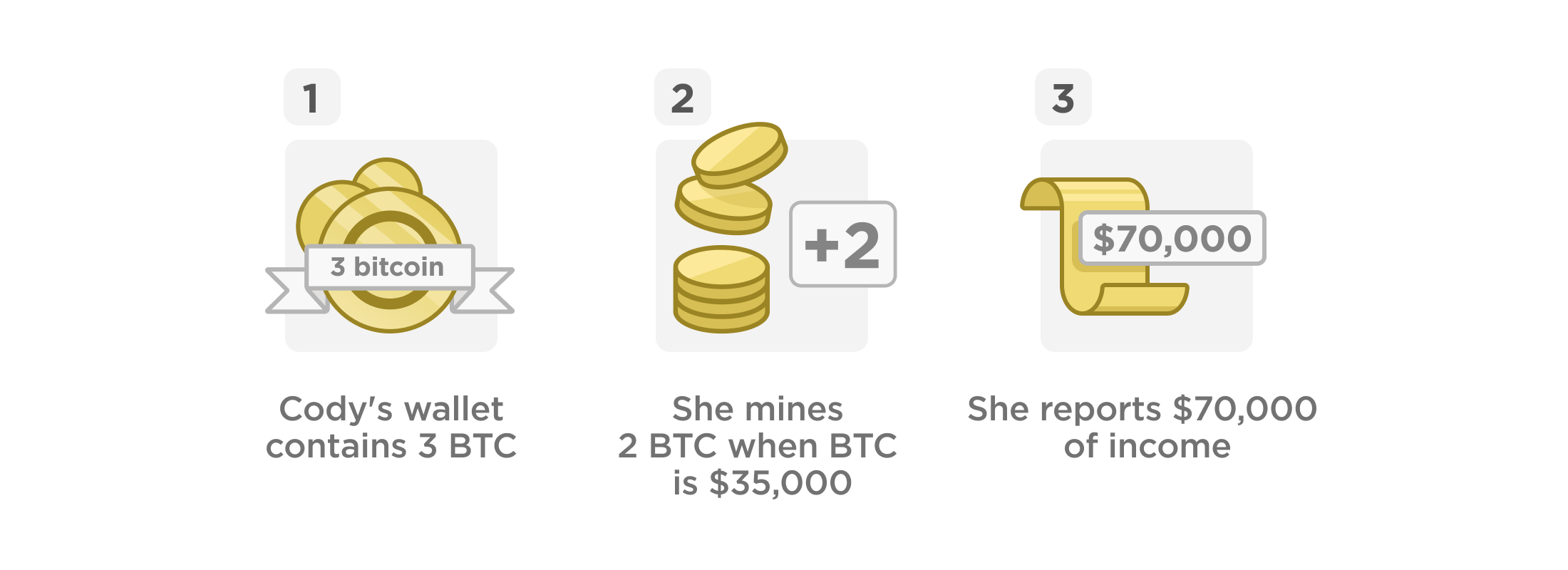

A crypto taxable event is triggered when earned crypto is deposited into your wallet. This means you will owe cryptocurrency mining taxes on its value at the time it is earned, regardless of any gains or crypto losses to its value during the rest of the tax year.

For this reason, it is very important to keep detailed records on Bitcoin or other crypto mining: when coins were earned, how much was earned, and what its fair market value was when earned.

You will also owe capital gains taxes on mined crypto if when you ultimately dispose of it, it has increased in value. To use the example above, if you sold the .25 BTC you mined when it was worth $9,000, you would owe capital gains tax on the $1,500 increase in its value.

Is crypto mining income taxed twice?

As noted, US-based crypto miners can anticipate two types of taxation on their crypto mining rewards: income tax on the fair market value of the mining rewards upon receipt, and capital gains taxes upon disposal.

Mining income (rewards) themselves are not taxed twice unless the crypto is disposed of later, at which point the usual capital gains rules apply.

If your mined crypto decreases in value, you may benefit from crypto tax-loss harvesting as a strategy to minimize capital gains taxes.

Cryptocurrency miners outside of the United States are subject to different tax rules: Explore our detailed info on international crypto taxes

Will there be a 30% tax on mining activity?

In 2023, the Treasury Department proposed a 30% excise tax on crypto mining businesses. At this time, it’s very unclear whether the 30% excise tax will pass Congress and become law. We will continue to update this article.

How do I report crypto mining income on taxes?

How to report crypto mining on taxes depends on your region and whether your crypto mining income was derived from activity as a hobby or a business. As noted, US-based taxpayers can anticipate paying taxes on mined crypto as both income and capital gains.

How are nodes taxed?

Validator nodes constantly run online software, staying up-to-date on all or part of the chain's ledger in order to validate transactions and reach consensus. On proof-of-work (PoW) chains like Bitcoin, validator nodes are not financially rewarded. Rather, their work enables miners, who compete to calculate a hash this quickest in order to add new blocks to the ledger and receive Bitcoin in return.

However, on proof-of-stake chains, such as Ethereum 2, blocks are not "mined," rather they are "forged" or "minted" by the validator nodes themselves, which are required to have staked coins to the network. When a node is selected to add a new block, the staker is rewarded with coins. These rewards are taxed as income, just as mined crypto would be.

How to report crypto mining on your taxes: hobby vs. business

Whether you mine crypto as a hobbyist or professionally under a formal business will determine how to report crypto mining on taxes each year. For example, crypto miners operating under a business can deduct certain expenses.

Here’s a breakdown of crypto mining tax implications as a hobbyist and business.

Crypto mining taxes for a hobby crypto miner

Bitcoin, Ethereum, or other cryptocurrencies mined as a hobby are reported on your Form 1040 Schedule 1 on Line 8 as “Other Income.” It is taxed at your income bracket's tax rate.

This approach to mining taxes is the simplest. However, hobby mining is not eligible for business deductions.

Taxes on crypto mining as a business

To establish your mining operation as a business, you need to incorporate it or set it up as a sole proprietorship. Although sole proprietorships require no legal filing, they also offer no liability protection. For this reason, many choose to incorporate their crypto business as a pass-through entity (a partnership, LLC, or S Corp) or a C corporation.

Depending on the legal structure you choose for your mining business, you may need to report and pay crypto self-employment taxes.

If you choose to treat your mining as a business, earned Bitcoin is reported as income on your Form 1040 Schedule C.

Crypto mining tax deductions

Mining is a costly process, so there are incentives for treating it as a business to write off expenses. Miners should always consult with a crypto tax professional to determine which deductions are appropriate.

Make sure to keep careful documentation of any claimed deductions in case of a crypto tax audit. Some common mining business expenses include:

Electricity

Electricity is typically one of a crypto miner’s largest expenses. Power used exclusively for mining may be deducted as a business or trade expense. This means that if you are mining in your home or another property that uses electricity for purposes other than mining, you may only deduct the portion of your electricity bill attributable to Bitcoin mining.

Make sure to keep careful documentation of your business’ electricity usage. A separate meter may help with this calculation.

Equipment

In most cases, the purchase price of a rig may be deducted in the year of its purchase using a Section 179 depreciation deduction, which allows companies to treat tangible business-related purchases as expenses rather than requiring them to be capitalized and depreciated.[1]

If your crypto tax professional does not find a Section 179 depreciation deduction appropriate for a mining-related purchase, the cost of that equipment may be deducted over several years (typically 3 to 5) using the modified accelerated cost recovery system (MACRS).

Additionally, the cost of repairs made to mining equipment may be deductible as a trade or business expense.

Office space

If you rent space to house your mining rig, the rental expense may be deductible.

If you mine out of your home, regardless of whether you rent or own, you may be eligible for the home office deduction.

If so, you can use the IRS’s guidance to calculate the portion of your housing costs that you can deduct, or use the simplified option, which deducts a set rate of expenses based on the amount of square footage occupied solely by your business.

Losses

The hardware and electricity expenses of a mining rig, combined with a volatile crypto market, mean that a mining business can lose money over a tax year. In this case, losses may be able to offset other income.

Crypto tax software to help reporting crypto mining

Crypto tax software can be an enormous help when determining how to report crypto mining on taxes. A crypto tax calculator is a piece of software that helps to calculate cryptocurrency profits, losses, income, and corresponding tax liabilities.

TokenTax is the industry-leading crypto tax calculator and full-service accounting firm that provides everything you need in order to completely and accurately file your crypto mining taxes. Our platform integrates with dozens of popular exchanges and wallets to make crypto mining tax reporting simple.

Consult a crypto tax accountant for additional guidance, and consider TokenTax VIP for full-service crypto accounting.

Schedule a FREE crypto tax consultation

How do you avoid taxes on crypto mining?

There are several simple ways to minimize taxes on crypto mining. Here are some options:

Run your crypto mining activity as a business and write off expenses, as outlined above.

Invest using an IRA

Consider a crypto tax-loss harvesting strategy to take advantage of dips in the market and minimize capital gains year-over-year.

Leverage our crypto tax software and apply one of numerous crypto accounting methods to minimize your tax liability.

Relocate to a crypto tax free country where there's no taxes on crypto mining.

Donate crypto or consider gifting crypto to friends, family or a charity.

Sell crypto during low-income periods.

Finding the cost basis of pre-mined coins

Miners sometimes have the opportunity to "pre-mine," or mine coins prior to an Initial Coin Offering. Because these coins are mined before there is a market for them, it is not clear how one would determine their cost basis for tax purposes.

There is no explicit guidance from the IRS on this topic. We recommend working with your crypto tax accountant to determine a fair market value. However, if a given coin is truly illiquid it is likely that reporting a cost basis of $0 is not unreasonable.

Federal income tax brackets for the 2022 and 2023 tax years

For reference, here are the 2022 and 2023 federal income tax brackets.

U.S. income tax brackets (2023 tax year, due 2024)

| Tax rate | Single filer | Married filing jointly | Married filing separately | Head of household |

|---|---|---|---|---|

| 10% | Up to $11,000 | Up to $22,000 | Up to $11,000 | Up to $15,700 |

| 12% | $11,000 to $44,725 | $22,000 to $89,450 | $11,000 to $44,725 | $15,700 to $59,850 |

| 22% | $44,725 to $95,375 | $89,450 to $190,750 | $44,725 to $95,375 | $59,850 to $95,350 |

| 24% | $95,375 to $182,100 | $190,750 to $364,200 | $95,375 to $182,100 | $95,350 to $182,100 |

| 32% | $182,100 to $231,250 | $364,200 to $462,500 | $182,100 to $231,250 | $182,100 to $231,250 |

| 35% | $231,250 to $578,125 | $462,500 to $693,750 | $231,250 to $346,875 | $231,250 to $578,100 |

| 37% | More than $578,125 | More than $693,750 | More than $346,875 | More than $578,100 |

U.S. income tax brackets (2022 tax year, due 2023)

| Tax rate | Single filer | Married filing jointly | Married filing separately | Head of household |

|---|---|---|---|---|

| 10% | Up to $10,275 | Up to $20,550 | Up to $10,275 | Up to $14,650 |

| 12% | $10,276 to $41,775 | $20,551 to $83,550 | $10,276 to $41,775 | $14,651 to $55,900 |

| 22% | $41,776 to $89,075 | $83,551 to $178,150 | $41,776 to $89,075 | $55,901 to $89,050 |

| 24% | $89,076 to $170,050 | $178,151 to $340,100 | $89,076 to $170,050 | $89,051 to $170,050 |

| 32% | $170,051 to $215,950 | $340,101 to $431,900 | $170,051 to $215,950 | $170,051 to $215,950 |

| 35% | $215,951 to $539,900 | $431,901 to $647,850 | $215,951 to $323,925 | $215,951 to $539,900 |

| 37% | more than $539,900 | more than $647,850 | more than $323,925 | more than $539,900 |

Crypto mining taxes FAQs

Here are answers to some frequently asked questions about crypto mining taxes and how to report crypto mining on taxes.

Do you have to pay taxes on Bitcoin mining?

Yes. The IRS taxes the income you receive from crypto mining as ordinary income based on the fair market value on the day you received the mining rewards.

Should I report my mining activity as a business or a hobby?

Mining crypto as a business gives you some legal protections and allows for certain tax deductions, as outlined above. Hobby mining is simpler in terms of setup and tax reporting, but if you actively mine professionally, a business is likely the better choice to maximize your returns.

Can the IRS track crypto mining?

Yes, the IRS has partnerships in place that allow them to monitor activities on the blockchain and connect individuals to accounts through know-your-client (KYC) processes on popular centralized exchanges. The best approach is to assume the IRS knows as much about your transactions and crypto activity as you do, and to report accordingly. Our expert team at TokenTax can help.

Do you have to pay taxes on crypto if you don't cash out?

Typically yes, whether you sell mined crypto or not, you’ll be subject to income taxes. For US-based taxpayers, crypto mining tax applies to both receipt of mined crypto (income from rewards) and sales of the same (as capital gains). If you do not sell your mining rewards, capital gains taxes will not apply.

To stay up to date on the latest, follow TokenTax on Twitter @tokentax.

Related Content

References

Last reviewed by Zac McClure,MBA on November 15, 2023 · Sources