Guide to Crypto Taxes in Australia for 2024

TokenTax content follows strict guidelines for editorial accuracy and integrity. We do not accept money from third party sites, so we can give you the most unbiased and accurate information possible.

The Australian Tax Office (ATO) provides guidelines on cryptocurrency taxes. Depending on the transaction types, the ATO treats crypto earnings as capital gains or as ordinary income taxes. It also has outlined tax policies for bitcoin mining, trading between fiat and other cryptocurrencies, gifts and purchases of goods and services.

In Australia, you pay tax based on your activities for the year trailing 30 June (starting July 1) of the year in which you file taxes. You have plenty of time to understand the nuances of your cryptocurrency taxes as the tax report deadline is October 31.

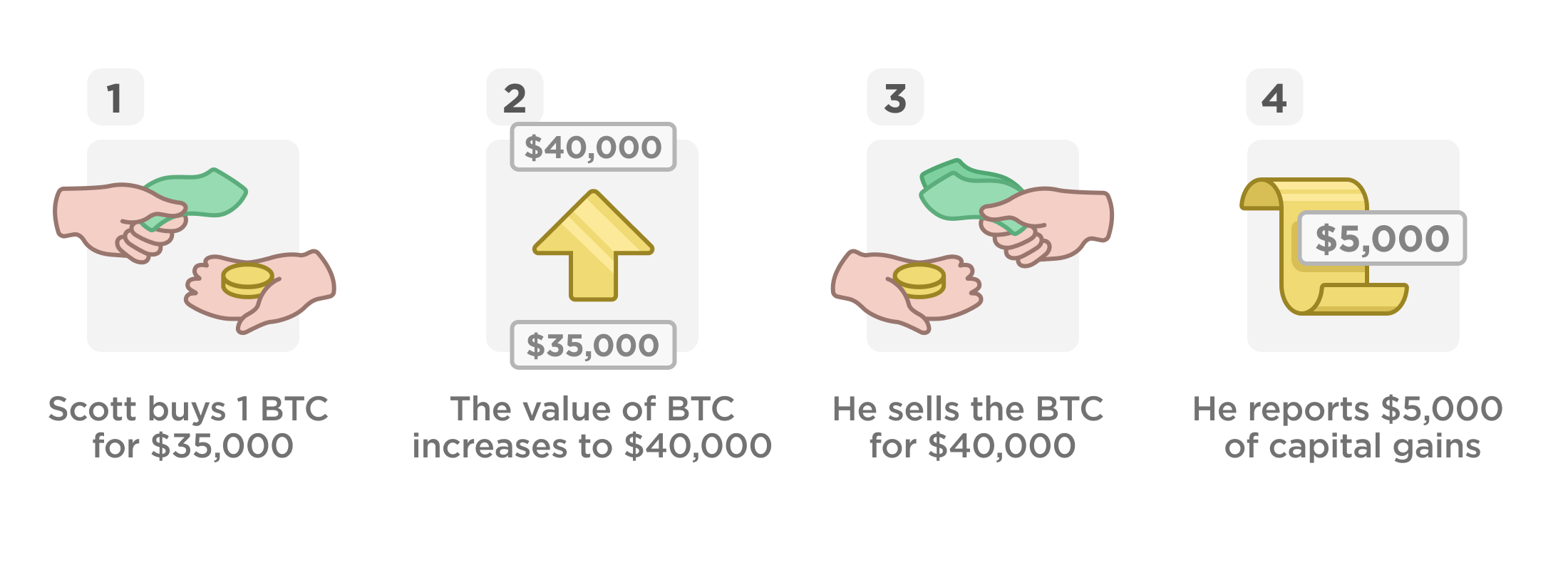

Crypto sales and swaps: Capital gains tax

Crypto-to-crypto transactions and crypto to fiat (i.e. AUD) trades are subject to capital gains taxes. When you sell or exchange a crypto asset, you subtract the cost basis (amount you originally paid for the crypto) from the proceeds (sales price total) to calculate your crypto gain or loss from that trade.

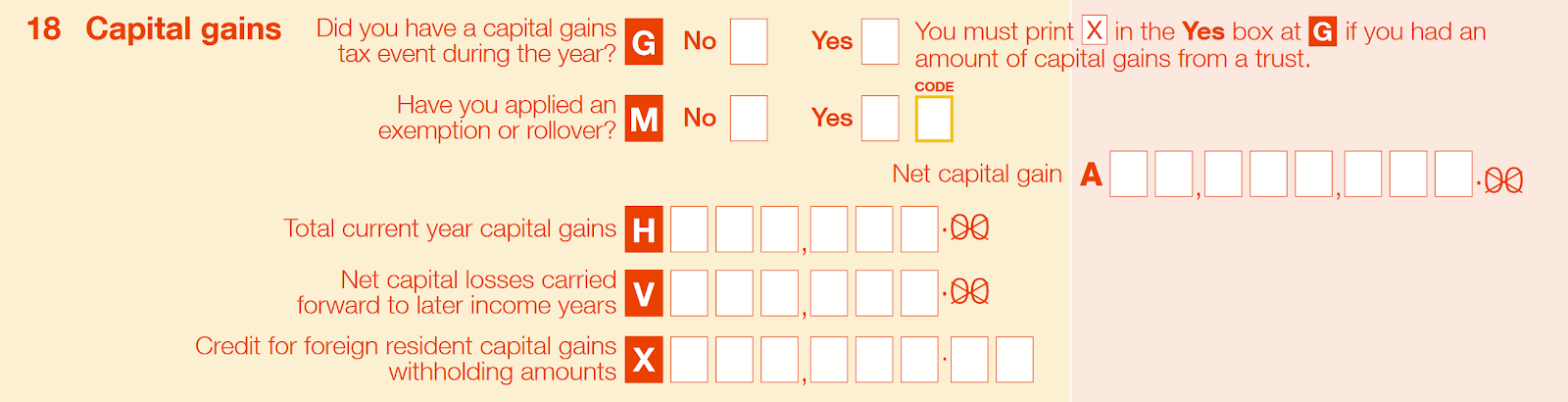

The total capital gains for your crypto trades are reported in Section 18 of the Australian tax forms. Note that if you wait 12 months before selling or exchanging away the crypto, there is a 50% discount on your capital gains before the tax rate is applied.

In Australia, you are only allowed to take losses against future capital gains. For example, if you have a net capital loss this tax year, you cannot use it to reduce your income tax. You can use the net capital loss to offset your capital gains in future tax years.

2022 Update to Cryptocurrency Capital Gains Taxes

On October 25, 2022, The Australian Taxation Office released 2022-23 budget papers stating that crypto transactions will be taxed as an asset rather than as a foreign currency. Central Bank Digital Currencies (CBDCs), however, will still be taxed as foreign currency.

As a result, a crypto gains tax will be applied to profits gained through trading or selling on centralized exchanges.

This digital currency tax legislation will be backdated to July 1, 2021.

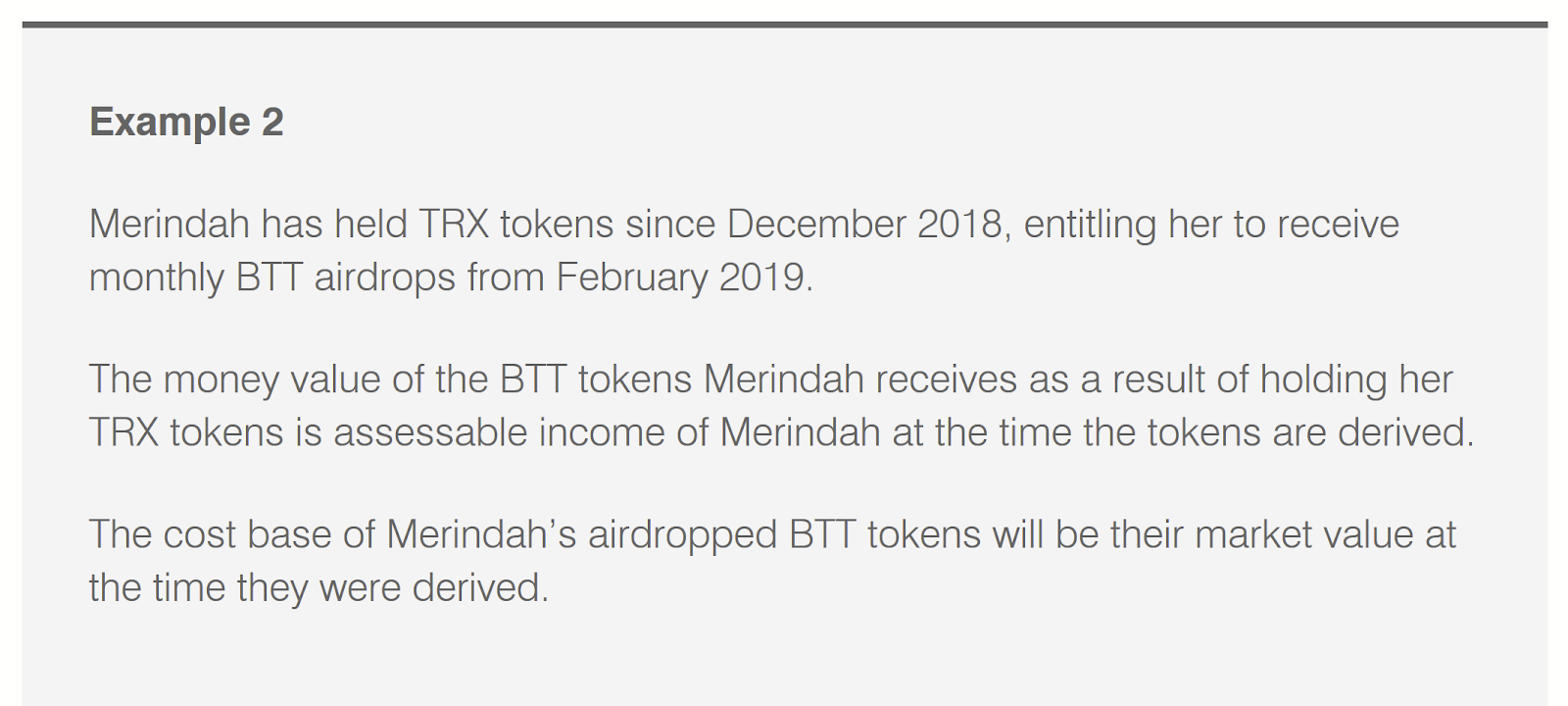

Airdrops and staking rewards: Ordinary income tax

Australia taxes airdrops and staking rewards as ordinary income.[1] If you subsequently trade that income for crypto or cash, any increase in its value will be taxed as a capital gain. The cost basis for this exchange will be the value of the crypto at the time you earned it.

The ATO provides a few examples to clarify the two-step tax process:

Crypto income is reported on Question 2 of the Australian tax forms.

Hard forks: Not taxable

In the event of a hard fork (chain split), the investor will not realize ordinary income or a capital gain when they receive the new cryptocurrency. If the new asset is held and then sold, profit will be taxed as a capital gain with a cost basis of $0.

Crypto gift tax

Crypto gifts are treated the same way as crypto trades. When you give crypto as a gift, its value at the time of your gift is your sale value. You are taxed on the difference between your sale value and your purchase value.

Australian crypto gifts example

You buy $600 worth of BCH.

Later, you give it to your niece. At the time of the gift, the BCH is valued at $800.

Your report $200 of capital gains.

Similarly, if receive crypto as a gift, you realize a capital gain at the time you exchange or sell the crypto. Your cost basis is the value at the time you received the crypto gift.

Australian crypto gifts example

You receive $800 dollars worth of BCH as a holiday gift.

You exchange it the next year for $1,000.

You have $200 of taxable gains.

Business crypto tax

If you are a corporation or "share trader," such as an exchange, mining entity, or someone trading crypto as a business, the ATO taxes your cryptocurrency gains or income as ordinary income. You may also be able to deduct business expenses from your earnings.

Losses are also taken into account as part of the corporate accounting books, the same as would be true of any business activity utilizing dollars. The ATO has examples of corporate crypto taxes on different business activities.

Crypto accounting methods

The ATO clarified that average investors can use any crypto accounting method, as long as each tax lot can be specifically identified. However, if you are classified as a "trader," or someone conducting crypto trades as a business, you can only use HIFO or average cost basis accounting.

Crypto wash sales

In summer 2022, the ATO warned taxpayers that crypto wash sales are forbidden, and could result in penalties for those who try to use them to reduce their capital gains totals.[2]

Tax deductions for stolen crypto

Per ATO guidance, stolen crypto can be deducted as a loss. The ATO does require careful documentation to substantiate these claims.

Crypto personal use assets

Very short-term crypto holdings of less than $10,000 may be tax exempt if they are used in full to make a single, one-time purchase. The requirements are very strict, so trading activity would definitely not fall into this category.

Here's an example of a transaction that might be: If you could only buy a television in Bitcoin, so you traded dollars into Bitcoin for the exact purchase amount and bought the television that same day, you may be tax exempt, but this is a gray area where you should consult with a crypto tax professional.

To stay up to date on the latest, follow TokenTax on Twitter @tokentax.

Related Content

References

Last reviewed by Tynisa (Ty) Gaines,EA on December 15, 2023 · Sources