How to Report Crypto Losses and Reduce Your Crypto Taxes April 2024

TokenTax content follows strict guidelines for editorial accuracy and integrity. We do not accept money from third party sites, so we can give you the most unbiased and accurate information possible.

Individuals may be able to reduce their taxable income by reporting crypto losses on taxes and potentially lower their overall tax liability. US taxpayers can use crypto losses to offset taxes on gains from the sale of any capital asset and up to $3,000 in income, with carryover into the future.

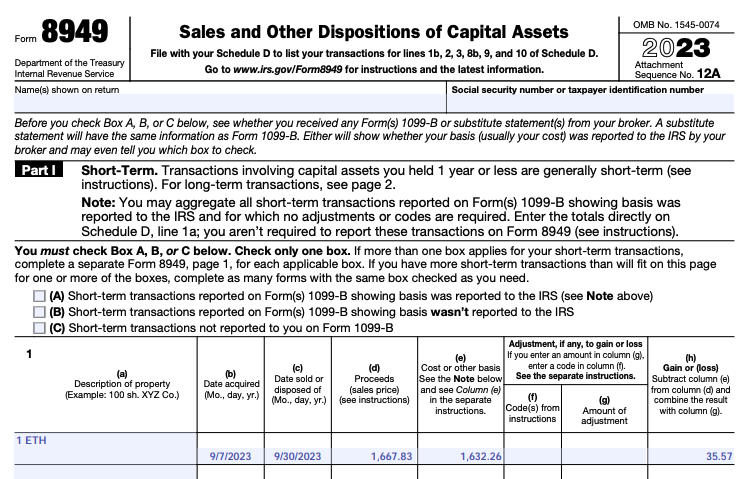

To report crypto losses on taxes, US taxpayers should use Form 8949 and 1040 Schedule D. Every sale of cryptocurrency during a given tax year should be reported on Form 8949.

Can you write off crypto losses on taxes?

Cryptocurrency losses can offset taxes on capital gains from various assets, such as stocks, real estate, and profitable crypto trades. Reporting these losses on your tax return is crucial to reap the benefits. This can decrease your taxable income, ultimately resulting in significant savings on your total tax bill.

In this guide, we teach you how to maximize tax advantages from cryptocurrency losses during both the current and future tax seasons so you can formulate a comprehensive crypto tax strategy. When in doubt, consult a crypto tax professional like ours at TokenTax.

You can also use our free crypto profit calculator to make plans, imagine future gains, and calculate potential crypto losses.

How to write off your crypto losses

Reporting crypto losses on taxes is important for two primary reasons:

The IRS requires that you report all sales of crypto, as it considers cryptocurrencies property.

You can use crypto losses to offset capital gains (including future capital gains if there is applicable carryover) and/or to deduct up to $3,000 from your income.

There are two ways in which reporting crypto losses can lower your crypto taxes: one is through income tax deductions, and the other is to offset capital gains.

Income tax deduction

If you experience total capital losses across all assets, you may deduct up to $3,000 from your income. You may not deduct losses from your income if you experienced total capital gains across all assets, but you can still use these losses to offset capital gains in other assets.

Excess net capital losses can also be carried forward to future years to be deducted against capital gains and against up to $3,000 of other kinds of income.

Offsetting capital gains

Regardless of your assets' collective performance, virtual currency losses can be used to offset other capital gains, either from the current tax year or future tax years (if carried forward).

How to offset capital gains example:

In 2022, Jill had net gains of $4,000 and net losses of $30,000, for an overall capital loss of $26,000, which she reports on her income taxes.

In 2023, she has more success in the market and has an overall gain of $15,000. She can use $15,000 of her $26,000 of 2022 losses to completely offset her gains.

In 2024, Jill has $20,000 of overall gains. She uses the remaining $11,000 of her 2022 losses to offset some of her gains, reducing her capital gains total to $9,000.

Strategically selling assets at a loss in order to offset your gains is called crypto tax-loss harvesting.

Do capital losses offset short-term or long-term capital gains?

Capital losses are at first applied to offset capital gains of the same nature, which is to say short-term losses are first subtracted from short-term gains and long-term losses from corresponding long-term gains.

If net losses of either short- or long-term capital gains remain after this is done, they can then be used to deduct against gains of the opposite kind.

Crypto losses to offset gains example:

Short-term capital gains: $5,000

Short-term capital losses: $7,000

Long-term capital gains: $8,000

Long-term capital losses: $6,000

Step 1: Apply losses to offset gains of the same nature.

$5,000 short-term capital gains - $7,000 short-term capital losses = -$2,000 short-term net loss.

$8,000 long-term capital gains - $6,000 long-term capital losses = $2,000 long-term net gain.

Step 2: If there are remaining losses of either type, apply them to offset gains of the opposite kind.

In this example, we have $2,000 in short-term losses we can use to offset long-term gains of $2,000, resulting in no long-term capital gains for tax purposes.

Tax savings by claiming crypto losses

Theoretically, there is no limit to how much you can save on your taxes by reporting crypto losses on taxes if you have corresponding capital gains from other assets. US taxpayers can even use crypto capital losses to offset ordinary income, up to $3,000 per year.

In order to claim a loss, you will need to have made a crypto taxable event on the asset. This means selling, trading for another crypto, or spending crypto. Otherwise, the loss remains unrealized and cannot be reported as a capital loss.

Crypto tax loss harvesting strategies

With crypto tax-loss harvesting, you can pinpoint unsold assets that are at a loss before the end of the tax year. For example, if you invested in many ICOs, you may be holding some coins that you can sell to claim a loss and lower your tax liability.

After ensuring you meet the conditions for tax-loss harvesting, you may want to learn about the TokenTax plans that include access to our Tax Loss Harvesting Dashboard, which allows you to quickly and easily realize losses in order to reduce your tax liability.

More about crypto tax loss harvesting: Guide to crypto tax loss harvesting

Offset gains with crypto losses

You can sell crypto at a loss and purchase it again. However, selling and rebuying an asset within 30 days is considered a crypto wash sale. In the US, wash sales are not permitted for securities in order to prevent taxpayers from claiming artificial losses and maximize their tax benefits.

Because cryptocurrency is not considered a security, wash sales are technically permitted for crypto. This may change in the future as politicians and regulators have indicated that the rule may be extended to crypto at some point. We recommend safer strategies to reduce your capital gains totals.

Report your crypto losses with TokenTax

TokenTax makes reporting crypto losses on your tax return. We provide a user-friendly data import feature, allowing users to effortlessly sync all their wallets and accounts, eliminating the need for manual data entry, in addition to real-time tax reports so users can preview their tax liability and be well-prepared for their filings.’

TokenTax users can also access specialized reports for tax loss harvesting, mining and staking income, and Ethereum gas fees. TokenTax automatically generates all necessary tax forms, including Form 8949, FBAR, and international forms, making the filing process hassle-free.

For investors with more complex accounting needs, TokenTax offers advanced reconciliation services from crypto-savvy tax professionals. This service is tailored to handle situations with missing cost basis or messy data, high transaction volumes, and cross-chain transactions. By providing comprehensive tools and expert assistance, we make reporting capital losses easy and ensure you can meet your crypto tax obligations with ease.

Schedule a FREE crypto tax consultation

Calculating crypto losses

To calculate your crypto capital loss, you use the same formula you would for calculating crypto gains: Proceeds - cost basis = capital loss.

Proceeds are the total sum you received upon disposing of the asset, while cost basis is the total sum for which you acquired the asset, including any transaction or gas fees. The result of your calculation will be negative if you've experienced a loss.

What are short- and long-term gains?

Short-term capital gains and losses come from selling property that you held for one year or less. These gains are typically taxed as ordinary income at a rate between 10% and 37% in 2022.

Long-term capital gains and losses come from the sale of property that you held for more than one year and are typically taxed at preferential long-term capital gains rates of 0%, 15%, or 20% for 2022.

Capital loss example:

You buy 5,000 UST for $5,000 on Coinbase, and pay a 1% transaction fee ($50). This makes your cost basis $5,050.

After the Terra Luna crash, you sell your 5,000 UST for $100.

$100 - $5,050 = -$4,950.

You report a $4,950 loss on your taxes.

After calculating and reporting individual transactions, you also need to find your net losses and gains so you can determine if you have overall losses or gains. If you have overall losses, you can carry forward losses to future tax years.

Report your crypto losses — even if you don’t get your tax forms

It is the responsibility of the individual taxpayer to comply with tax regulations. US taxpayers must report their crypto activity to the IRS on their taxes whether or not they’ve received corresponding forms from exchanges.

Crypto exchanges like Coinbase do report information to the IRS without sending tax forms to users, and crypto investors have received IRS letters recommending that individuals report their crypto taxes and/or pay more taxes.

Many leading crypto exchanges will send crypto 1099s to investors with more than $600 of rewards income, meaning that the IRS will also receive a report of each trader's activity in some cases.

Exchanges that do not send 1099s can be compelled to share information with the IRS through a John Doe summons, an investigative tool increasingly used by the Biden administration.

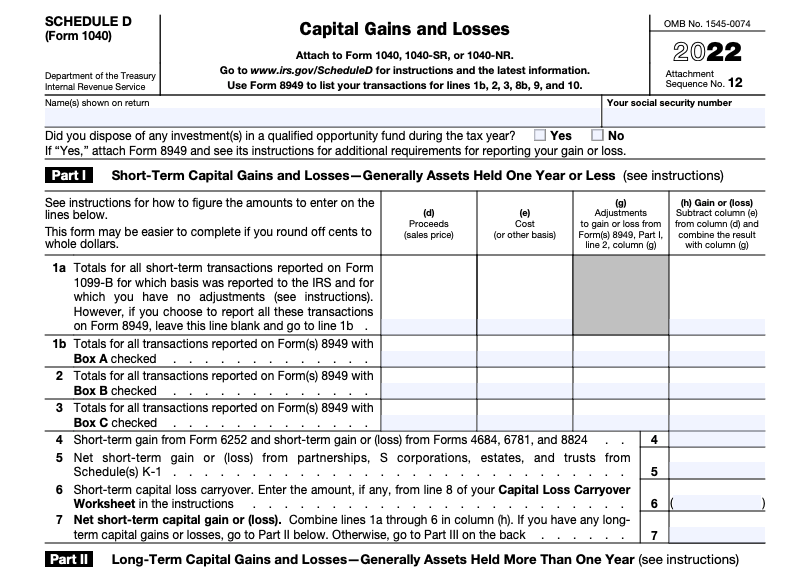

Forms to claim your crypto losses

There are certain forms that you should use when reporting crypto losses on taxes: Form 8949 and 1040 Schedule D. Each sale of crypto during the tax year is reported on the 8949. If you had non-crypto investments, they need to be reported on separate Form 8949s when you file your taxes.

The example below shows a completed crypto Form 8949 reporting a single loss.

See our How to Report Crypto on Your Taxes: 5-Step Guide for complete instructions on how to fill out Form 8949 and further details about how to claim crypto losses on taxes.

Your overall long-term and short-term gains and losses totals are reported on Form 1040 Schedule D. This is where you can also include losses carried forward from past years.

Challenges of reporting your crypto tax losses on your tax return

Calculating and reporting losses for each of your cryptocurrency trades in a tax year can be tedious and painstaking.

It can also be troublesome to generate gains and losses reports when you have transferred crypto between wallets (such as Coinbase and Binance), because even the best crypto exchanges may not know the original cost basis of the transferred coin.

Reporting crypto losses FAQs

Here are answers to frequently asked questions, including do I have to report crypto losses, can you write off crypto losses, can you claim crypto losses on taxes, and how to claim crypto losses on taxes.

Can I report NFT losses on my taxes?

According to the IRS, any crypto-to-crypto transaction is a taxable event. For this reason, all of the following NFT activities are taxable capital gain/loss events for hobbyists:

Purchasing an NFT with cryptocurrency.

Trading an NFT for another NFT.

Selling or otherwise disposing of an NFT for a fungible cryptocurrency.

Are you looking for more guidance on NFT loss reporting? See our NFT Tax Guide for more information.

Do you pay taxes on crypto losses?

The short answer is no. If you have an asset that you hold at a loss, you need to realize the loss or sell the asset. If you have not sold the asset, it remains unrealized.

When you realize a capital loss, that loss will be tracked, and it will add to your total capital losses. Your losses can be used to lower your capital gains through a process known as tax-loss harvesting.

Is reporting crypto losses to the IRS mandatory?

Reporting crypto losses on taxes is not mandatory. However, the IRS does require that you report all sales and disposals of crypto, as it considers cryptocurrencies to be property. Importantly, if you neglect to report your crypto losses, you cannot use your losses to offset capital gains or income, potentially resulting in adverse financial consequences.

Can I write off lost or stolen cryptocurrency?

If you’ve been hacked or rug-pulled, you’re probably wondering if you can get tax deductions for crypto scams.

Unfortunately, if you no longer retain ownership of the crypto, there is no clear method for claiming theft losses. In 2018 the IRS clarified that the only losses allowed to be written off with Form 4686 (Casualties and Thefts) were those assets lost as a result of a federally declared disaster, so stolen crypto cannot be written off.

Even though you can't get a deduction for stolen crypto, it’s important that you record the theft in your TokenTax crypto tax software so it doesn't erroneously match up those tax lots with sales.

What happens if I don't report crypto losses?

The IRS requires US taxpayers to report all cryptocurrency transactions, including sales for losses. Failure to properly report can lead to penalties and increased scrutiny from the IRS, and if you don’t report crypto losses, you cannot use them to offset capital gains or income.

I hold crypto at a loss but haven't sold it. Can I claim the loss?

Merely holding cryptocurrency at a loss does not result in a taxable event for US taxpayers. To declare a capital loss in cryptocurrency, you must engage in a taxable event involving the asset. These events include selling for fiat currency like USD, exchanging for another cryptocurrency, or using the crypto to purchase goods or services. If no such event occurs, the loss remains unrealized and cannot be claimed as a capital loss.

Can I claim tax relief on crypto losses?

US taxpayers can typically leverage crypto losses to mitigate taxes on gains from capital assets. By recognizing and reporting these losses, individuals have the opportunity to lower their taxable income, potentially resulting in significant reductions in overall tax liability. Strategies like crypto tax-loss harvesting and tools like ours at TokenTax can help taxpayers optimize and manage their crypto portfolios.

Can I write off crypto losses on taxes if I have no gains?

Yes, you can write off crypto losses on taxes even if you have no gains. If your total capital losses exceed your total capital gains, US taxpayers can deduct the difference as a loss on your tax return, up to $3,000 per year ($1,500 if married filing separately). Any excess losses can be carried forward to future tax years.

Do I need a certified public accountant (CPA) to claim crypto losses on taxes?

While it's not required to have a CPA to claim crypto losses on taxes, it can be beneficial. A CPA can help ensure that you're correctly calculating your losses, taking advantage of all available deductions, and complying with tax laws. A crypto tax professional like ours at TokenTax can also provide guidance on tax planning strategies to minimize your tax liability.

How do crypto transactions affect my taxable income?

Engaging in crypto transactions, such as purchasing, selling, trading, or using cryptocurrency, can affect your taxable income. Capital gains from selling cryptocurrency are generally subject to taxation, while losses can be utilized to offset other capital gains, potentially reducing your overall taxable income. It is crucial to maintain detailed records of all your crypto transactions and seek advice from a tax professional to comprehend the tax ramifications.

To stay up to date on the latest, follow TokenTax on Twitter @tokentax.