Guide to Crypto Tax-Loss Harvesting 2024

TokenTax content follows strict guidelines for editorial accuracy and integrity. We do not accept money from third party sites, so we can give you the most unbiased and accurate information possible.

Investors use crypto tax-loss harvesting as a strategy to sell assets at a loss during market dips or at the end of the tax year and so offset other capital gains, which potentially lowers their total tax liability.

US taxpayers can sell an unlimited amount of assets at a loss and may be able to deduct up to $3,000 per year to offset ordinary income if capital losses exceed capital gains. Remaining losses can be carried forward into future tax years to offset capital gains or income.

What is tax-loss harvesting?

Cryptocurrency tax-loss harvesting is a technique that involves selling crypto at a loss to offset the gains you have made, ultimately reducing your total tax liability. This strategy is commonly employed towards the end of the year when investors have a clear picture of their total gains or during market downturns when losses are more pronounced.

This method can be applied to digital currencies and other assets, such as payouts from mutual funds at the end of the year. Suppose your losses for the year exceed your gains. In that case, after accounting for investment gains, you can deduct up to $3,000 of those losses annually (or $1,500 if you're married and filing separately) from your regular income.

Tax-loss harvesting allows you to neutralize gains and potentially reduce your ordinary income by up to $3,000 in the current or future tax year. It's important to understand that this strategy postpones your tax payments rather than eliminating them.

The fundamental concept is that when you eventually pay the deferred taxes through tax-loss harvesting, your investment portfolio should have grown significantly more than the amount of tax you owe. Executed properly over time, this strategy can result in a higher overall net worth.

Everything you need to know about tax-loss harvesting with crypto

How to reduce your crypto tax bill

Crypto is treated as a capital asset, like property or stocks. You only realize a crypto capital gain or loss when you sell, trade, or spend it. This means that if you are holding an asset that has lost value, you have not yet realized this crypto loss.[1]

Reporting crypto capital losses on your return has tax benefits. If you have a total capital loss in crypto, you can use that loss to offset gains in other capital assets, like stocks. You could also deduct up to $3,000 from your income taxes.

Otherwise, you can carry forward that capital loss to deduct from future capital gains, whether in crypto or in other asset classes.

This means that you can still benefit from harvesting losses if you don't have capital gains to offset that same year; there is no expiration date on losses you carry forward to offset future gains or income.

Tax harvesting is often used to offset capital gains, but, even if you don’t have gains, you may still want to harvest losses so that you can lower your taxable income or offset gains associated with other asset types.

Crypto tax loss harvesting example

You have $5,000 in capital gains for the tax year.

You also have some ETH that is worth $2,500 less than what you paid for it over a year ago.

If you don't sell the ETH you will have $5,000 of taxable gains.

If you harvest your losses and sell the ETH, you will only have $2,500 of capital gains.

Crypto tax-loss harvesting timing

You need to harvest your losses during the tax year. Once the tax year is over, your gains and losses are locked in. Most people elect to harvest their losses in the last month of the tax year. If you’re a U.S. taxpayer reading this near the end of the calendar year, that means it’s time to act now.

Market dips are also popular times to harvest losses, since lower asset prices result in larger losses. Consequently, more gains can be offset.

How much of my losses should I harvest?

There is no limit on the amount of losses you can harvest, so you and your crypto tax advisor can develop a strategy to sell as many assets at a loss as you'd like.

For example, you could sell off assets so that you have $0 in capital gains, or you can sell enough so that you have an overall capital loss.

Challenges of crypto tax-loss harvesting

Tax-loss harvesting can be simple for traditional assets like stocks, which likely don’t have many varying cost bases and holding periods.

With crypto, however, it can get a little more complex. You can have countless different cost bases and holding periods for major coins like BTC and ETH.

How do I handle short- vs. long-term gains when tax-loss harvesting?

Keep in mind that there are different crypto tax rates for long-term and short-term trades; long-term capital gains are taxed at a favorable lower rate in the U.S.

For example, let's say you have unrealized losses in ETH. Some losses are in short-term holdings, and some are in long-term holdings.

Your crypto tax advisor may suggest that you harvest losses on the short-term holdings rather than the long-term holdings, so that if ETH prices increase in the future, you will be able to pay the lower long-term capital gains tax rate once you sell it for a profit.

How do I tax-loss harvest NFTs?

In theory, you can tax-loss harvest NFTs just like you would a fungible token. However, the process can come with extra challenges, such as difficulty estimating fair market values or struggling to realize a loss on a worthless asset.

Read our: NFT Tax Loss Harvesting Guide.

What if I have unrealized losses and gains for a single cryptocurrency?

If you have unrealized gains and losses for a single cryptocurrency, it's important that you're careful when documenting your tax lots so you don't inadvertently report gains instead of losses.

Tax-loss harvesting with unrealized gains and losses of the same crypto

You bought 1 BTC at $4,000 and 1 BTC at $10,000.

BTC is now trading at $8,000, so you have a $2,000 unrealized loss and a $4,000 unrealized gain. Your total capital gains for the year are $20,000.

You plan to harvest the $2,000 loss. If you sell the right tax lot, you will reduce your capital gains total by $2,000 to $18,000.

However, if you sell the tax lot acquired at $10,000, you will increase your capital gains total by $4,000 to $24,000.

One-on-one sessions with a crypto tax accountant can help you use specific ID accounting to identify the right crypto lots to sell in order to claim the right amount of capital loss.

If you are interested in setting up a session with one of TokenTax’s crypto tax accountants, please reach out to us at [email protected].

Crypto tax-loss harvesting with TokenTax

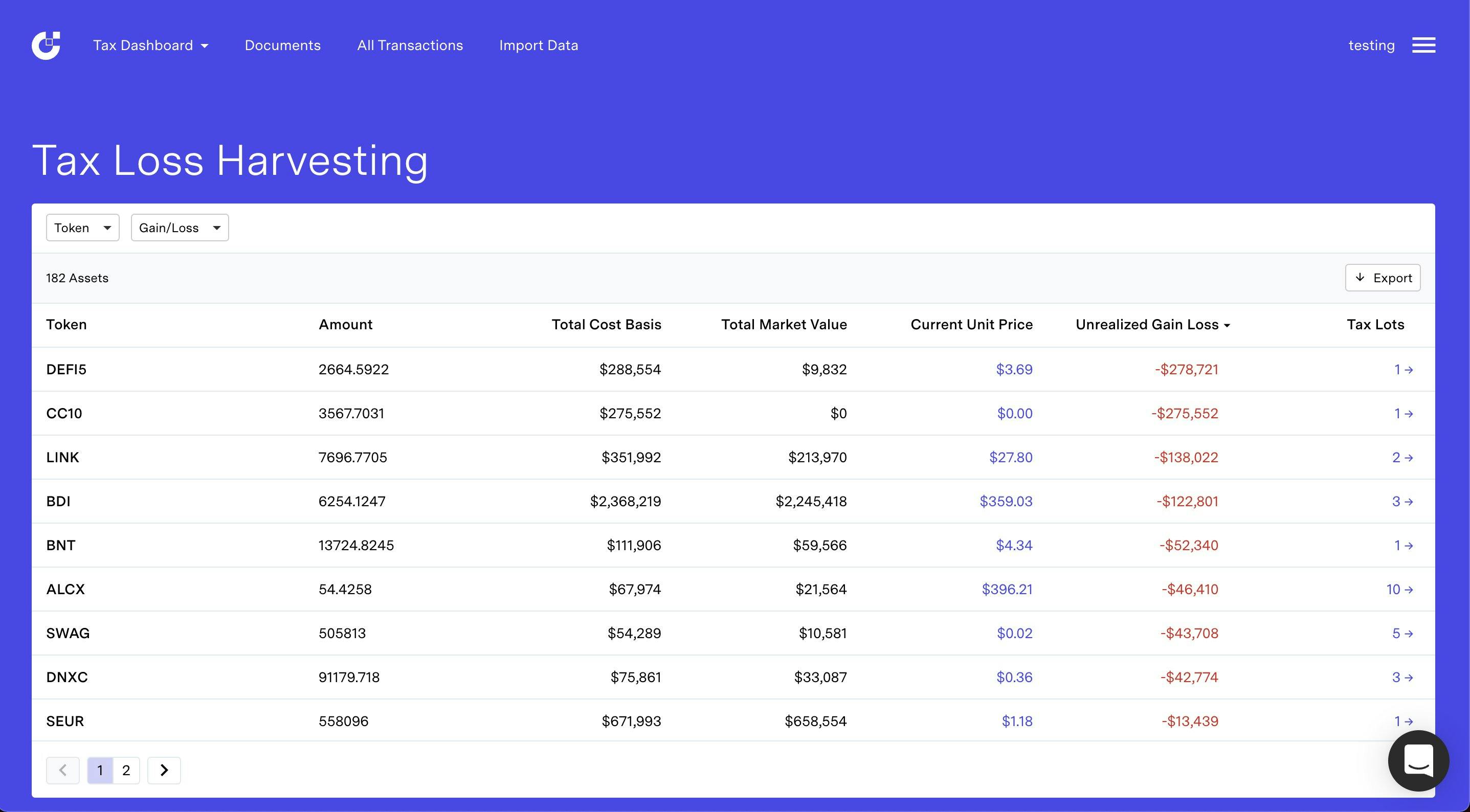

With our crypto tax software, you can automatically import all of your crypto data and access your own tax loss harvesting dashboard to find unrealized losses.

TokenTax's tax loss harvesting dashboard automatically identifies unrealized losses in your portfolio, making it easy to find opportunities to reduce your capital gains taxes.

Our tax-loss harvesting tool uses your crypto transaction history to calculate exactly how much of each coin you hold and how much of an unrealized loss or gain you have on each cryptocurrency. This allows you to get a bird's-eye view of opportunities to loss harvest.

The bonus of tax-loss harvesting with a TokenTax plan is that you’ll have all your data completely imported by the end of the tax year. This means that when it’s time to put together your tax return next year, all you need to do is export your Form 8949 that our software generates for you.

Schedule a FREE crypto tax consultation

Risks of tax-loss harvesting

The risks associated with this strategy that crypto investors should pay attention to include:

Lowering the crypto cost basis

There is risk associated with tax-loss harvesting, even for experienced investors.

One risk is that loss harvesting can lower your crypto cost basis. A capital gain is generated when the sale price of an asset (the amount you sold it for) is higher than the cost basis of that asset (the amount you paid for it). When the cost basis is lowered, the result is a higher capital gain, which means a higher tax bill.

In a scenario such as this one, you would benefit in the current year from tax loss harvesting, but your savings would be canceled out by the higher taxes you would owe in the future due to a higher capital gain on the asset in question.

Variables such as market fluctuation and changes in personal income or tax rates can affect the taxes you will owe on an asset in the future. However, capital gains - the taxable profit generated from your asset - will inevitably be calculated using the asset's cost basis. For this reason, loss harvesting could potentially create a loss in the future, even if it saves you money on your tax bill for the current year.

Crypto wash sales

It’s entirely legal to harvest your losses at the end of the year. However, if you buy back your assets immediately, this could constitute a crypto wash sale.

Currently, crypto assets are not technically covered by the wash sale rule, which only applies to securities. However, multiple pieces of proposed legislation have aimed to ban crypto wash sales.

Although none have been passed, investors should be aware that the issue is on the legislative agenda and check with their crypto tax advisors before engaging in wash sales.

Because of associated risks, we always recommend that you consult your CPA before attempting to tax-loss harvest.

Crypto tax-loss harvesting FAQs

Here are answers to some frequently asked questions about crypto tax-loss harvesting.

How much can you tax-loss harvest on crypto?

There is no set limit on the amount of losses you can harvest. We recommend developing a loss harvesting strategy with your crypto tax advisor to most effectively minimize your tax burden.

Is there a limit to tax-loss harvesting?

There is not a limit in terms of losses you can harvest. However, if you have overall capital losses, there is a limit to the losses you can use to offset ordinary income on your federal taxes.

If your capital losses exceed your capital gains for the year, you can deduct up to $3,000 of these losses to offset regular income. You cannot deduct an amount higher than your capital losses for the year, but additional losses may be carried forward to offset capital gains or income in future tax years.

How often should I harvest my losses?

Due to the volatile nature of cryptocurrency, there are multiple market dips throughout the year when tax-loss harvesting crypto could be advantageous. While many investors wait until the end of the tax year to take action on this strategy, you can save money and time by harvesting losses throughout the year.

What’s the deadline for tax-loss harvesting?

Because your gains and losses are locked in at the end of the tax year, you must harvest crypto losses by then. If you are a US taxpayer, that means that your crypto tax-loss harvesting must be completed by the end of December of the tax year in question.

Should I harvest tax losses crypto?

If you have a total capital loss in crypto, you can use that loss to offset gains in other capital assets, deduct up to $3,000 from your income, or carry that loss forward to deduct from future capital gains in crypto or other asset classes.

Always refer to your CPA for tax-related questions. If you and your CPA agree that you stand to benefit from harvesting crypto losses, tax-loss harvesting would be a strategic and useful move.

Does the wash sale rule apply to cryptocurrency?

Technically no. However, the Biden administration has begun to investigate crypto cases more closely, and the loophole that currently allows crypto wash sales may eventually be closed, making crypto wash sales illegal. Further questions or concerns? Our team of experts at TokenTax will be happy to help.

Is tax-loss harvesting legal?

Tax-loss harvesting in crypto is a legal and widely employed strategy to minimize tax liability. Should you have any questions, our crypto tax professionals can assist and guide you in developing a legal and effective crypto tax strategy.

How do you tax loss harvest on Coinbase?

To properly tax loss harvest on Coinbase, it's essential you keep an accurate record of all your crypto transactions both on and off that platform.

If you purchased crypto elsewhere and moved it to Coinbase, for example, you'll need to have an accurate record of our purchases to determine your cost basis. Our software and integrations at TokenTax can help ensure you have a complete record of your crypto transactions.

Should I sell my crypto at a loss for tax purposes?

The decision to sell crypto at a loss for tax purposes depends on individual circumstances and goals. This strategy can be beneficial, but investors should understand the complete tax and financial implications of doing so, weigh the pros and cons, and consider seeking advice from a crypto tax professional for best results.

Does tax loss harvesting actually save money?

Tax-loss harvesting can save money on current-year tax bills by strategically offsetting capital gains with realized losses. While it is a legal and widely used approach, investors should understand the risks, exercise caution, and consult with a crypto tax professional for personalized advice.

Can tax-loss harvesting apply to all cryptocurrencies?

Tax-loss harvesting can typically apply to any cryptocurrency recognized by tax authorities as a capital asset. This includes major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and others. However, note that the tax treatment of cryptocurrencies can vary by jurisdiction. It's advisable to consult a tax professional familiar with the regulations in your area.

What documentation is required for tax-loss harvesting?

Accurate documentation is essential for tax-loss harvesting. Investors should maintain detailed records of their cryptocurrency transactions, including purchase dates, sale dates, amounts, and prices. This information is necessary for calculating capital gains and losses accurately and for reporting purposes when filing taxes.

Additionally, keeping records of any communication with tax advisors or accountants regarding tax-loss harvesting strategies is recommended.

To stay up to date on the latest, follow TokenTax on Twitter @tokentax.

Related Content

References

Last reviewed by Tynisa (Ty) Gaines,EA on April 1, 2024 · Sources