How to Report Crypto on Taxes in 2024

TokenTax content follows strict guidelines for editorial accuracy and integrity. We do not accept money from third party sites, so we can give you the most unbiased and accurate information possible.

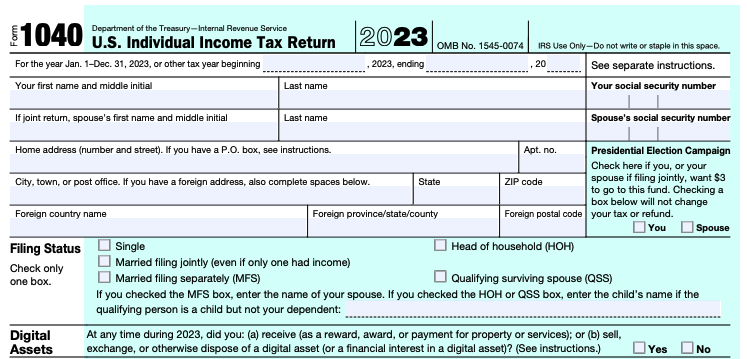

US taxpayers reporting crypto on their taxes should claim all crypto capital gains and losses using Form 8949 and Form Schedule D. Ordinary crypto taxable income should be included on 1040 Schedule 1 or with Schedule C for self-employment earnings.

US taxpayers should include these forms with their Individual Income Tax Return Form 1040 by the tax deadline, typically April 15th.

How to report crypto on taxes in five easy steps

To ensure compliance with tax regulations, follow these steps for reporting your cryptocurrency transactions:

Calculate your gains and losses from cryptocurrency transactions.

Complete Form 8949 to document your cryptocurrency transactions.

Transfer the totals from Form 8949 to Schedule D of your tax return.

Report any ordinary income from cryptocurrency on Schedule 1 of Form 1040 unless you're self-employed, in which case you should use Schedule C.

Finalize your tax return, and then submit and pay any taxes owed.

How to file crypto taxes in 2024

Reporting crypto taxes does not have to be a pain. Follow these steps:

Step 1: Calculate capital gains and losses on crypto

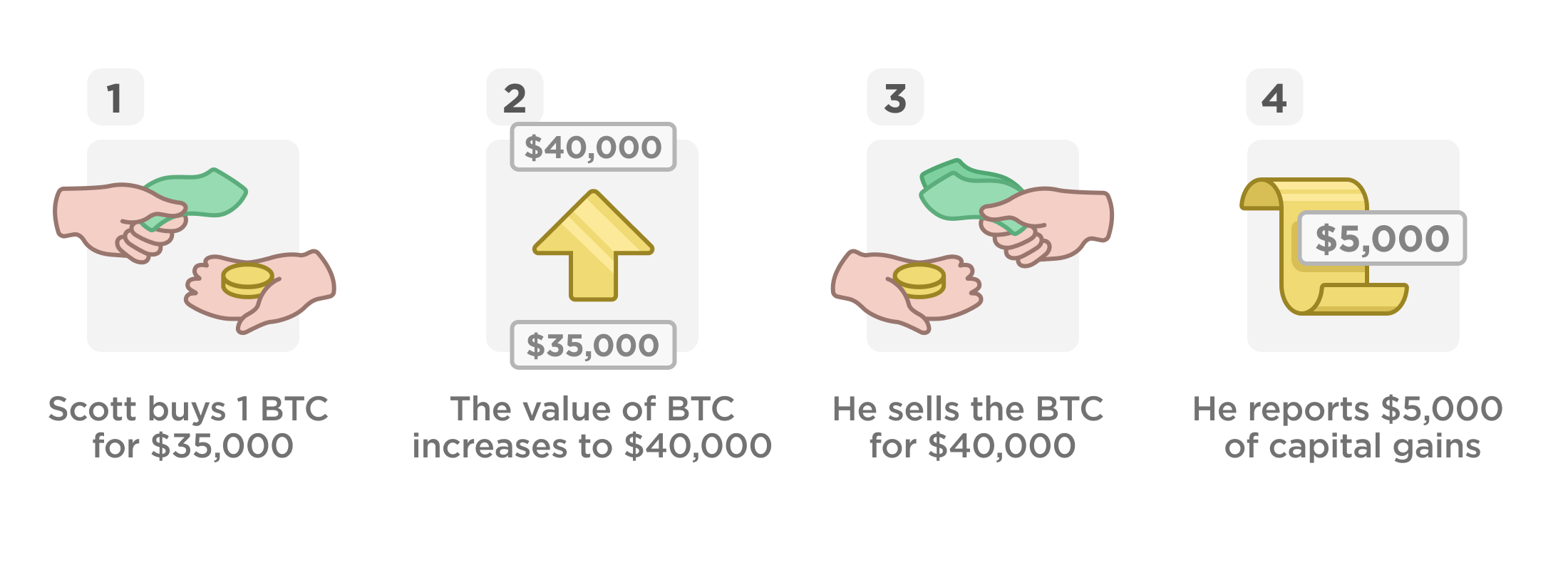

Every time you sell, trade, swap, or otherwise dispose of a digital currency, you experience a crypto taxable event and realize a capital gain or loss.

Crypto capital losses and gains may significantly change your tax liability in current or future tax years.

To determine the amount of the capital gain or loss, you must find the difference between the asset's value at the time of its disposal and its cost basis. An asset's cost basis is the amount for which it was acquired, including any exchange or transaction fees.

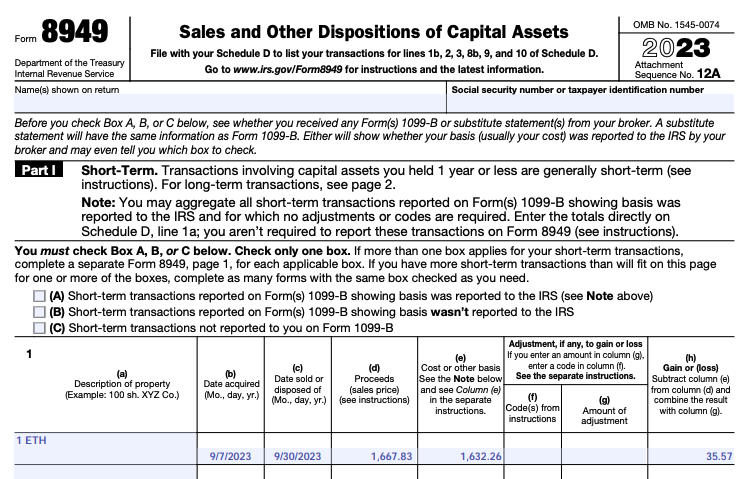

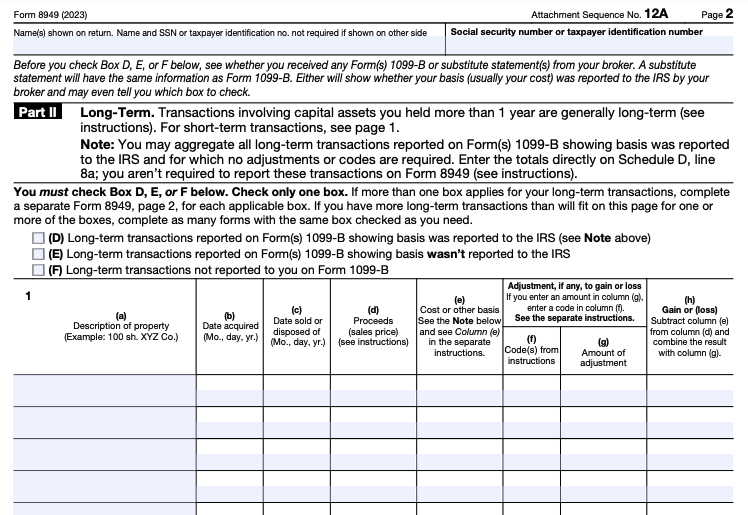

Step 2: Complete IRS Form 8949 for crypto

The IRS Form 8949 is the tax form used to report cryptocurrency capital gains and losses.

You must use Form 8949 to report each crypto sale that occurred during the tax year. If you had other (non-crypto) investments during the tax year, you must report them on separate Forms 8949 when you file your taxes.

Report crypto on your 8949

Fill in the information at the top of Form 8949.

Select check box (a), (b), or (c) for the short-term trades section in Part I:

(a) Short-term transactions reported on Form(s) 1099-B, showing basis was reported to the IRS

(b) Short-term transactions reported on Form(s) 1099-B, showing basis was not reported to the IRS

(c) Short-term transactions not reported to you on Form 1099-B

Exchanges are now obligated to provide both taxpayers and the IRS with Form 1099-B. If an exchange has provided you with a 1099-B, you will check (a) or (b).

If you do not receive a 1099-B, you will most likely need to select check box (c), although you should check with your exchange about a missing 1099-B.

Organize your calculations row by row and include the details of each transaction:

Description of property: This describes the asset that was sold, exchanged, or spent (Example: 1.5 BTC).

Date acquired (MM/DD/YYYY): This is the day you purchased the crypto asset that you are using as the cost basis for the transaction.

Date sold or disposed of (MM/DD/YYYY): This is the day you sold, exchanged, or spent the crypto asset.

Proceeds: Your proceeds are the gross USD value of crypto sold, exchanged, or spent.

Cost basis: Your cost basis is the gross USD value at which you acquired the crypto being sold, exchanged, or spent. This includes purchases in fiat currency or another cryptocurrency.

Adjustment, if any, to gain or loss: This code describes the adjustment amount you enter in column (g). Crypto taxpayers typically do not have any adjustments. However, the IRS instructions list capital gain adjustments for use if necessary (if, for example, you received a Form 1099 without a cost basis and need to report your purchase prices to the IRS).

Adjustment, if any, to gain or loss: This amount corresponds to the description code you entered in column (f). Typically, crypto taxpayers do not have any adjustments.

Gain or (loss): Subtract column (e) from column (d) and combine the result with column (g). This is your net capital gain (or loss) in USD for this particular transaction.

Below is an example of how to report crypto on taxes using Form 8949, showing a single short-term sale of ETH:

Include your totals in the aggregate boxes at the bottom of the form.

Total Proceeds: the sum of your transaction sales prices

Total Cost or other basis: the sum of your transaction acquisition prices

Total Adjustment, if any, to gain or loss: If you have adjustments, report the total here (no accompanying description is necessary).

Total Gain or (loss): the sum of your transaction capital gains or losses

Note that if you have been trading large volumes of crypto, your cost basis and proceeds totals may seem higher than you expected. This is normal, as they are the sums of all cost bases and proceeds.

Repeat these steps to populate the information for your long-term trades in Part II of Form 8949.

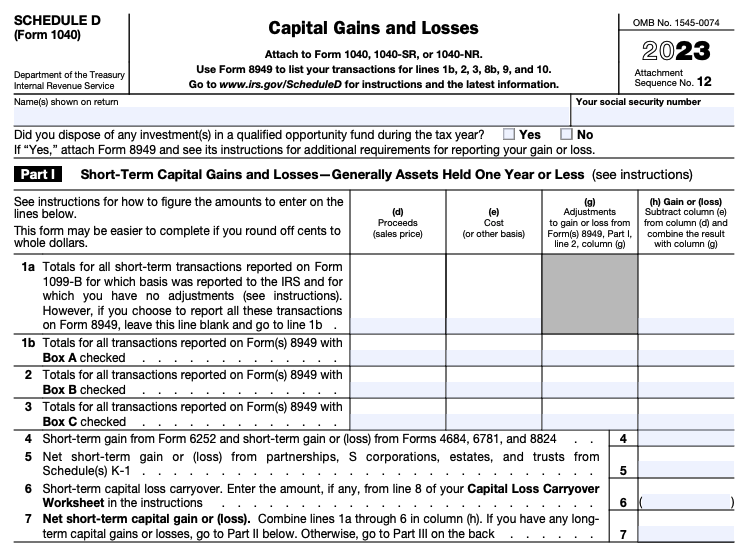

Step 3: Include Form 8949 with the Form 1040 Schedule D

Form 8949 is included with the Form 1040 Schedule D, which reports your overall capital gains and losses. List the totals for your short- and long-term capital gains and losses separately on this form, as they are subject to different crypto tax rates.

Schedule D also includes gains and losses from Schedule K-1s (used in reporting crypto taxes related to dividends, income, or losses if you are a partner in a financial entity or a shareholder in an S Corporation).

If you are carrying crypto capital losses forward from previous years or intend to carry capital losses forward from the current tax year to future years, you must report this on Schedule D as well.

Step 4: Reporting your crypto income

If you have received or disposed of cryptocurrency in a given tax year, you owe taxes on that cryptocurrency. Furthermore, if you have earned rewards or payments in crypto, you owe income taxes on this crypto just as you would for ordinary income in fiat.

Luckily, learning how to file crypto taxes for income is very similar to learning how to file income taxes for fiat, and you will use the same forms.

Ordinary income on Form 1040 Schedule 1

Although crypto profit is often reported as capital gains, there are instances in which it is recognized as ordinary income. These include crypto mining and staking, airdrops, hard forks, and crypto lending interest.

Form 1040 Schedule 1 asks, “At any time during 2023, did you (a) receive (as a reward, award, or payment for property or services); or (b) sell, exchange, gift, or otherwise dispose of a digital asset (or a financial interest in a digital asset)?”

This clarification of prior years’ questions underscores the fact that the IRS is interested in all crypto transactions - not just sales and swaps.

Total crypto income that you have received (with the exception of income you have earned through self-employment) is included in Form 1040 Schedule 1 “Additional Income and Adjustments to Income” on line 8 "Other income."

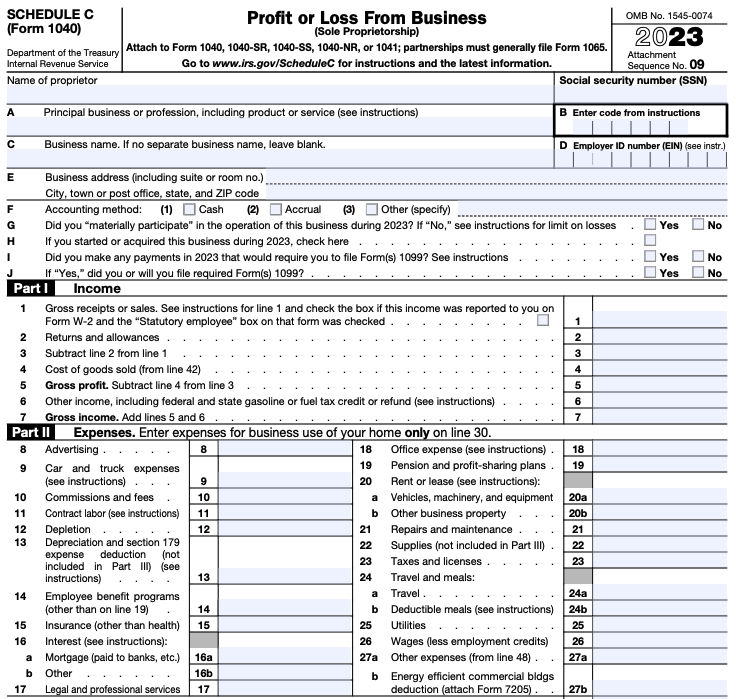

Self-employment income on Form 1040 Schedule C

A self-employed person - also referred to as an independent contractor - conducts business as a sole proprietor, member of a partnership, or by contracting with a business or trade directly.[1] In independent contracting situations, the payer often does not withhold taxes. As a result, this responsibility generally falls on the self-employed person, who must report self-employment income on Form 1040 Schedule C and pay crypto self-employment tax.

The IRS distinguishes between earnings you receive as a result of a hobby and those you generated from a business.[2] If the IRS considers your activity to be business- or trade-related, any income or rewards you earn will be treated as self-employment income.

If you are self-employed, you may be able to deduct expenses from your income. For example, it may be possible to deduct crypto mining expenses (such as your equipment and separately-metered electricity bill) for a crypto mining business. In a case such as this one, refer to Form 8829 Expenses for Business Use of Your Home.

Step 5: Complete your return

You have now concluded your cryptocurrency tax reporting, and this last step includes a few finishing details regarding how to file crypto taxes.

Complete the rest of your taxes, then your crypto tax accountant will be ready to file. Finally, you can pay your taxes, and this concludes the process of reporting crypto taxes!

Crypto tax forms at a glance

When learning how to file crypto taxes, it is important to familiarize yourself with the tax forms that will be necessary to include with your return. In addition to the list here, you can view examples of the required forms later in this article.

Form 8949

Form Schedule D

Form 1040 Schedule 1 (1040 Schedule D if your crypto earnings come from self-employment)

Do I need to report crypto on my taxes?

In short: yes, you need to report all crypto activity on your taxes. The IRS mandates that all crypto sales be reported, classifying cryptocurrencies as property.

Whether you trade, sell, swap, or dispose of crypto in any other way, it triggers taxable capital gains or losses for US taxpayers. Earnings from crypto mining, staking, and most yield farming are subject to income tax.

International taxpayers can refer to our helpful country guides for more information about regions outside the US.

How much crypto do I need to report to the IRS?

Bear in mind that crypto exchanges send Forms 1099-MISC to traders who earned more than $600 through crypto rewards/staking and to the IRS.

Due to the Infrastructure and Investment Jobs Act that the Biden administration signed into effect in November of 2021 cryptocurrency exchanges are required to issue a 1099-B since the beginning of this year.

However, exchanges do not necessarily know the cost basis (the amount a trader originally paid for the asset). This means that keeping close track of your cost basis will be more important than ever to ensure accuracy in your tax return

Read on: Does Coinbase Report to the IRS?

From forms to filing, TokenTax covers all your crypto tax needs.

Do I need to report crypto on my tax return?

It is a legal requirement to report cryptocurrency on your taxes, unless you did not realize a capital gain or loss through selling or swapping your assets during the tax year in question.

If you do not report cryptocurrency on your taxes and are found to have had fraudulent intent, you may be subject to 26 U.S. Code § 7201 - Attempt to evade or defeat tax or 26 U.S. Code § 7207 - Fraudulent returns, statements, or other documents.

It is important to remember that taxpayers who made a genuine mistake on their return will not be subject to these penalties.

If you were unaware that you needed to report cryptocurrency on previous years’ tax returns, you may be able to amend your returns using Form 1040-X.

Additionally, as of February 2022, taxpayers who are facing criminal prosecution for failing to disclose information regarding virtual currency to the IRS may be able to provide the information on Form 14457 - Voluntary Disclosure Practice Preclearance Request and Application.

It is essential to note that this enforcement of tax penalties in relation to cryptocurrency is unfolding in a rapidly changing space.

According to the IRS Criminal Investigation’s (CI) 2022 annual report, CI will continue to prioritize the tracing, monitoring, and tax basis calculation of cryptocurrency in 2024 to prosecute in instances they deem to be cryptocurrency tax crimes.

CI’s Cyber and Forensic Services announced that “During FY 2022 Digital Forensic lab and field staff took possession of approximately $4 billion of digital currency pursuant to seizure orders.”[3]

Tax implications of crypto scams and exchange shutdowns

Exchange shutdowns - such as the situation surrounding Bitfront - are a much-debated topic among tax professionals.

Some hold that investors can claim losses that result from an exchange shutdown (or a scam crypto project, such as a fraudulent NFT mint) on Form 8949 in order to receive a tax break. Others, however, claim that this scenario would constitute a personal casualty loss and would thus be non-deductible.

Claiming losses from an exchange shutdown or fraudulent crypto project on Form 8949 would be an aggressive and risky tax position to take. If you have been affected by a scenario like this, the best course of action is to consult your CPA before deciding how to handle losses.

Can you claim crypto losses on taxes? Ultimately, the only way in which a crypto loss or theft would qualify for a tax exemption would be by declaring it an investment loss. You can learn more about declaring crypto investment losses in our article "How to Report Crypto Losses".

How TokenTax can help to file your crypto taxes

Looking for a stress-free way to handle your crypto tax filing? TokenTax is your comprehensive solution, streamlining the entire process to ensure accuracy and ease, no matter your trading activities or location.

Seamless data management

Say goodbye to manual data entry hassles. TokenTax seamlessly syncs with your wallets and accounts, eliminating the need for tedious input. With support for DeFi, NFTs, margin, and futures trading, our platform is versatile and user-friendly. Easily detect and correct errors with our intuitive interface.

Real-time tax previews and comprehensive forms

Stay ahead of tax season with real-time previews of your tax liability. TokenTax's reports allow for FIFO, LIFO, Minimization, and average cost calculation methods along with features like a tax loss harvesting dashboard, crypto mining and staking income reports, and more. Generate essential forms, including Form 8949, FBAR, and international forms, with seamless integration for TurboTax users.

Advanced reconciliation services

For those with intricate needs, our advanced reconciliation services cater to missing cost basis, complex data situations, high transaction volumes, and cross-chain transactions. Explore our plans and pricing for stress-free crypto tax filing. Trust TokenTax and our crypto tax professionals for an efficient and accurate journey through crypto tax season.

Schedule a FREE crypto tax consultation

How to report crypto on taxes FAQs

Here are answers to some frequently asked questions about how to report your crypto taxes.

Do I need to report crypto if I don't sell?

No, you are not required to report crypto if you do not sell it. Cryptocurrency and other digital assets are considered property, so taxable events only occur when you realize capital gains or losses through actions like swapping, trading, selling for fiat, or other forms of disposal.

Will the IRS be aware if I fail to report crypto?

The IRS will likely become aware if you experienced taxable crypto events but did not report them on your taxes for that year.

All exchanges are required to provide taxpayers and the IRS with Form 1099-B, which reports certain transactions involving property, including cryptocurrency.

Is it necessary to report crypto transactions under $600?

US taxpayers must report every crypto capital gain or loss and crypto earned as income, regardless of the amount, on their taxes. Whether it's a substantial gain or a single dollar in crypto, if you experienced a taxable event during the tax year, it's your responsibility to include it in your tax return.

Compliance with reporting requirements ensures accurate financial documentation and adherence to IRS regulations. When in doubt, consult with a crypto tax professional.

Can the IRS see crypto accounts?

If the IRS does not already know about a taxpayer’s crypto holdings (as a result of exchanges such as Coinbase reporting to them), recent cases have shown that they may source the information they need in order to prosecute tax evasion through the use of John Doe summonses.

It is thus reasonable to assume that the IRS either knows about a trader’s crypto holdings, or could easily learn of them and hold the trader accountable. It is important to learn how to report crypto on taxes in order to avoid IRS penalties, which may be retroactive.

Can I write off crypto losses?

Please bear in mind that there is more than one way to interpret the question “can you claim crypto losses on taxes?”.

The first interpretation of this question pertains directly to lost and stolen crypto. Unfortunately, if someone stole cryptocurrency from you - or if you lost crypto through a mistake counted as “negligence,” such as sending it to the wrong address - you do not have much recourse.

However, you can write off crypto losses on your tax return if you classify them as an investment loss. This may allow you to deduct from your income or offset your capital gains, which would lower your tax liability.

How much crypto do you have to make to report on taxes?

Any amount of earned crypto needs to be reported on your taxes, however small. If you've made a dollar in profit or income from crypto, you are expected to report it.

You can use our free crypto profit calculator to make plans, calculate your profit, and imagine future gains.

Do I need to report cryptocurrency on my taxes?

Yes, US taxpayers are generally required to report cryptocurrency activity on their taxes if they've earned crypto as income or have disposed of crypto. The IRS mandates that every crypto sale, trade, swap, or disposal be reported, classifying cryptocurrencies as property.

Whether you have traded, sold, swapped, or disposed of crypto in any way, these actions trigger taxable capital gains or losses. Additionally, earnings from crypto mining, staking, and most yield farming are subject to income tax. It's crucial to accurately report all crypto transactions to comply with IRS regulations and avoid potential penalties.

Do I need to report crypto if I don't sell?

US taxpayers do not typically need to report crypto if you don’t sell. Because the IRS treats crypto and other digital assets as property, taxable events only occur when you realize capital gains or losses through swaps, trades, sales for fiat, or other methods of disposal.

If you receive crypto as income, or income through crypto from methods such as staking, you'll need to report.

How do I declare crypto on my tax return?

Following a systematic process is important when US taxpayers declare cryptocurrency on tax returns. Start by calculating capital gains and losses for each transaction, considering the difference between the asset's value at disposal and its cost basis.

Fill out IRS Form 8949 with details for each crypto sale, organizing information row by row. Include this form with Form 1040 Schedule D, where you report overall capital gains and losses, differentiating between short- and long-term transactions.

Report ordinary crypto income on Form 1040 Schedule 1, and if self-employed, use Form 1040 Schedule C.

Complete the rest of your tax return, ensuring accuracy, and then file and pay your taxes. For personalized guidance and best results, consult a crypto tax professional and use specialized crypto tax software like ours at TokenTax.

To stay up to date on the latest, follow TokenTax on Twitter @tokentax.

Related Content

References

Last reviewed by Arthur Teller,CPA on April 1, 2024 · Sources