How to Report Crypto on TurboTax in 2024

TokenTax content follows strict guidelines for editorial accuracy and integrity. We do not accept money from third party sites, so we can give you the most unbiased and accurate information possible.

When paired with TokenTax, TurboTax Premier makes taxes easy, with clear steps to follow that ensure accurate and thorough crypto tax filing.

TurboTax supports CSV imports from Coinbase, PayPal, CashApp, and Binance US. TokenTax also exports CVS documents you can use with TurboTax crypto.

Can I file cryptocurrency taxes on TurboTax?

Yes, TurboTax Premier supports cryptocurrency transactions and, when paired with TokenTax, makes complicated crypto tax filing simple. This article will walk you through how to report crypto on TurboTax with TokenTax.

TokenTax users can easily import their crypto tax documents to TurboTax crypto. Below, you'll find step-by-step instructions for importing your crypto Form 8949 from TokenTax into the web edition of TurboTax.

If you're looking for instructions for the CD/Download/Desktop version of TurboTax, you'll find these below the web instructions.

How to file Cryptocurrency Taxes with TurboTax (step-by-step)

If you’re reading this, you may be wondering, “Where do I enter crypto on TurboTax?” Here's how.

1. Generate your TurboTax crypto tax documents

Go to the "Documents" tab of your TokenTax dashboard. Click the "Create Report" button on the right side of the screen. You will then see a list of the reports you can create. Find "Form 8949 TurboTax CSV" and click "Generate Report." Your report will appear in your Downloads folder.

2. Start your tax return in TurboTax

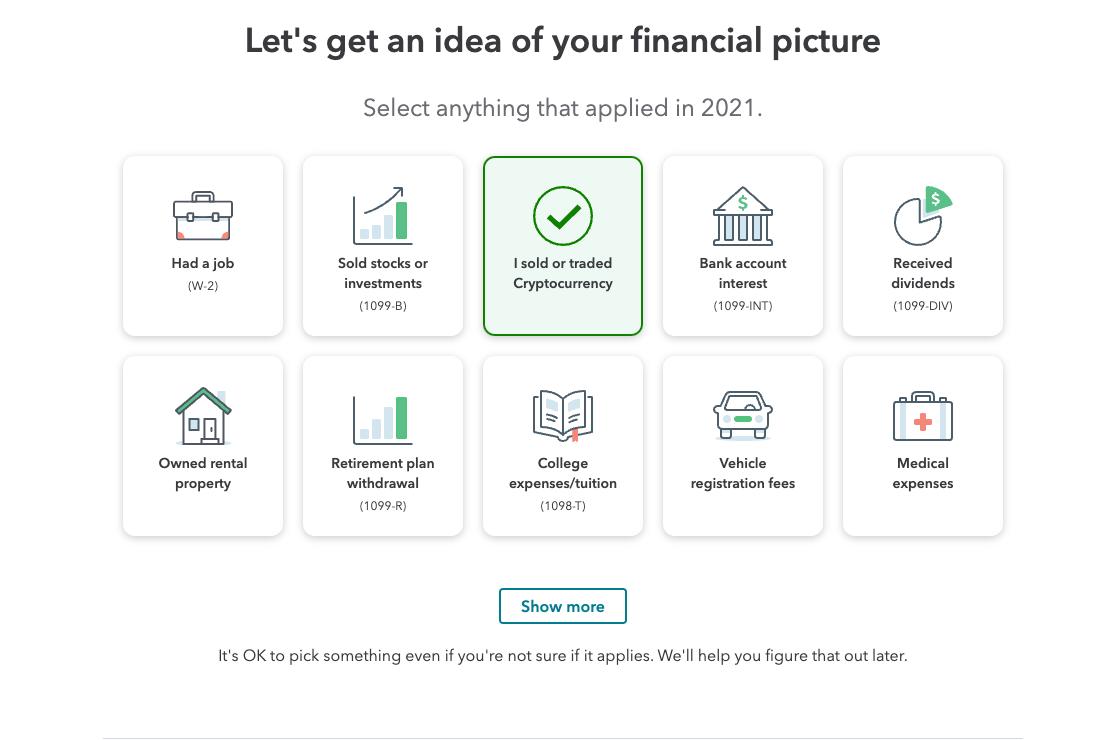

Create a TurboTax Premier account or log in, then begin the TurboTax introduction process. Select “I sold or traded Cryptocurrency” on the page titled “Let's Get an Idea of Your Financial Picture.”

3. Find the Wages & Income screen

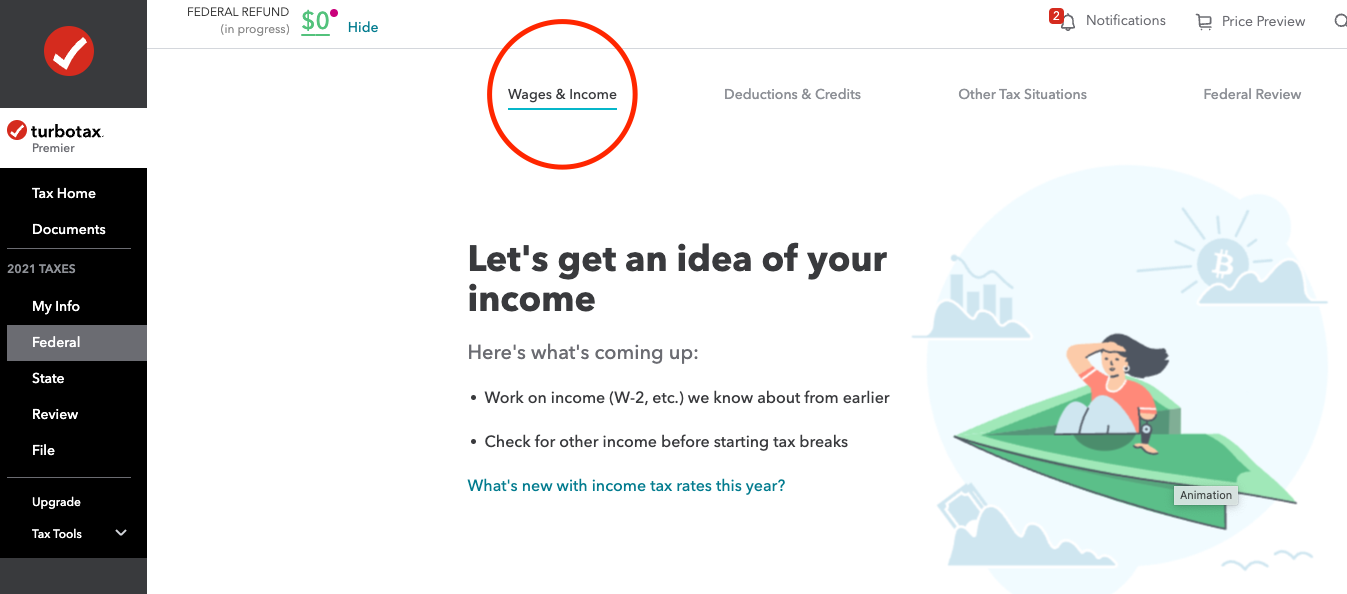

After entering your personal information, click "Federal" on the navigation bar on the left side of your screen. Then, on the page it displays, click "Wages & Income."

4. Import your TokenTax crypto tax documents to TurboTax

You’ll now upload your crypto documents from TokenTax to TurboTax in this step.

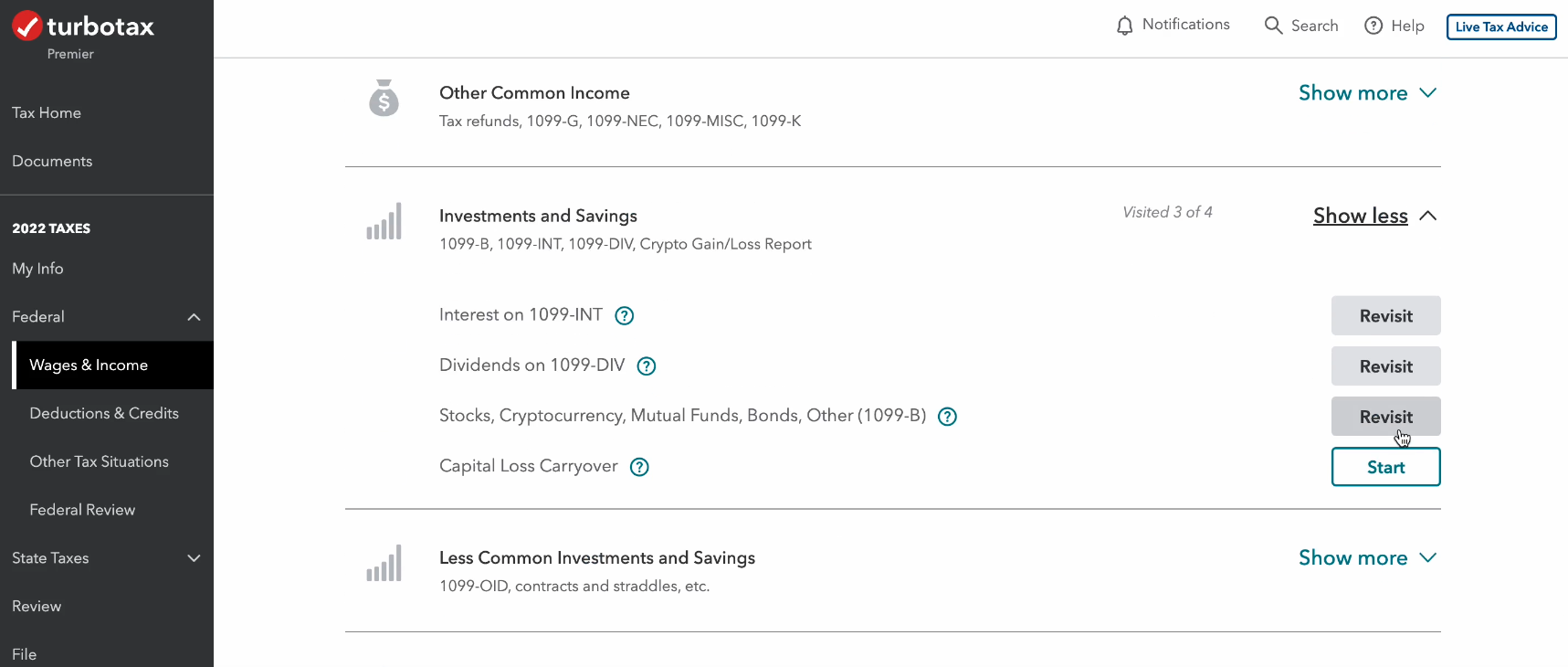

1. On the “Wages & Income” tab. Select the “Investments and Saving” toggle. Click "Revisit" next to the “Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B)” option.

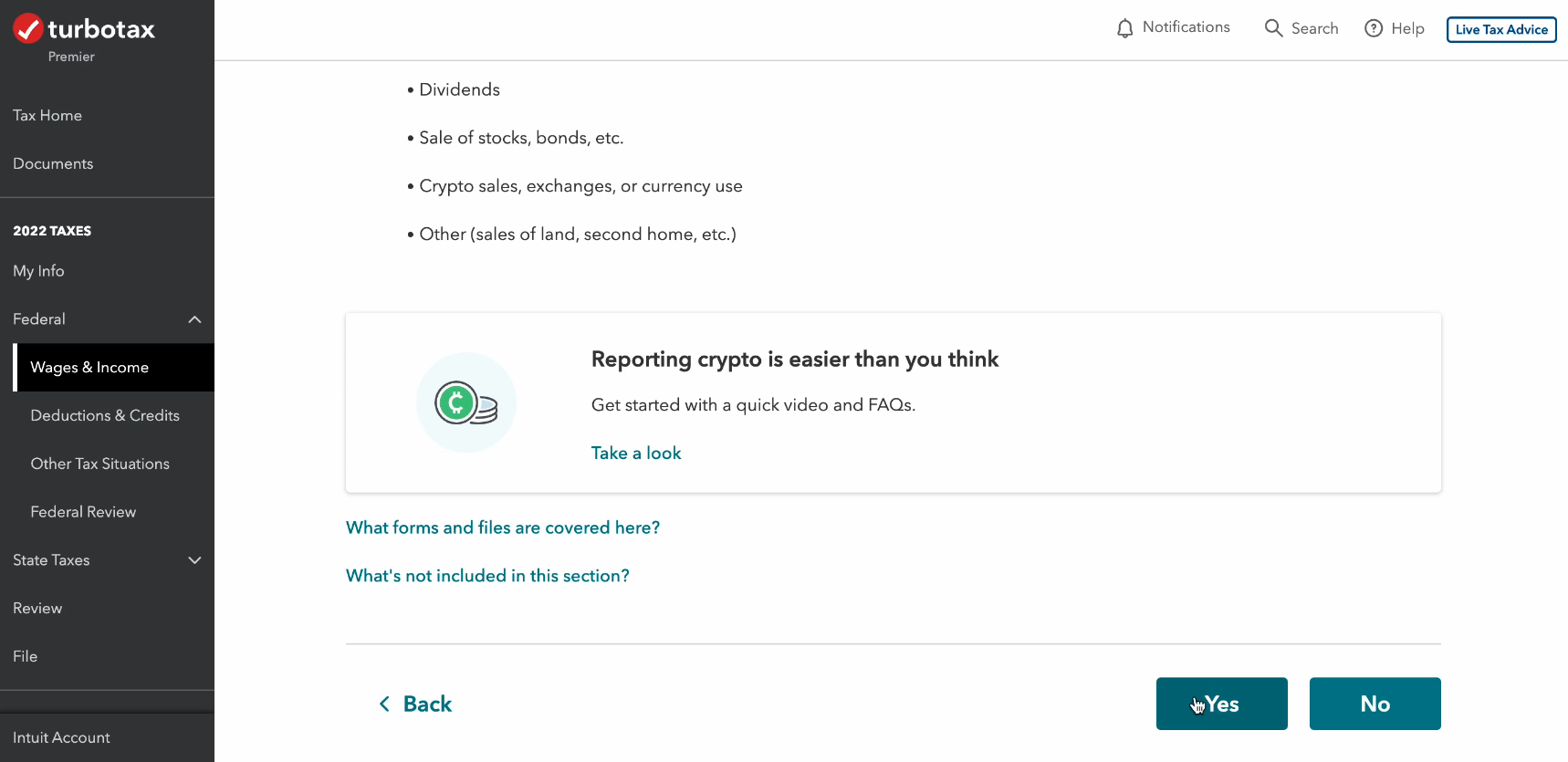

2. You’ll now be asked, “Did you have investment income in 2022?” Select “Yes.”

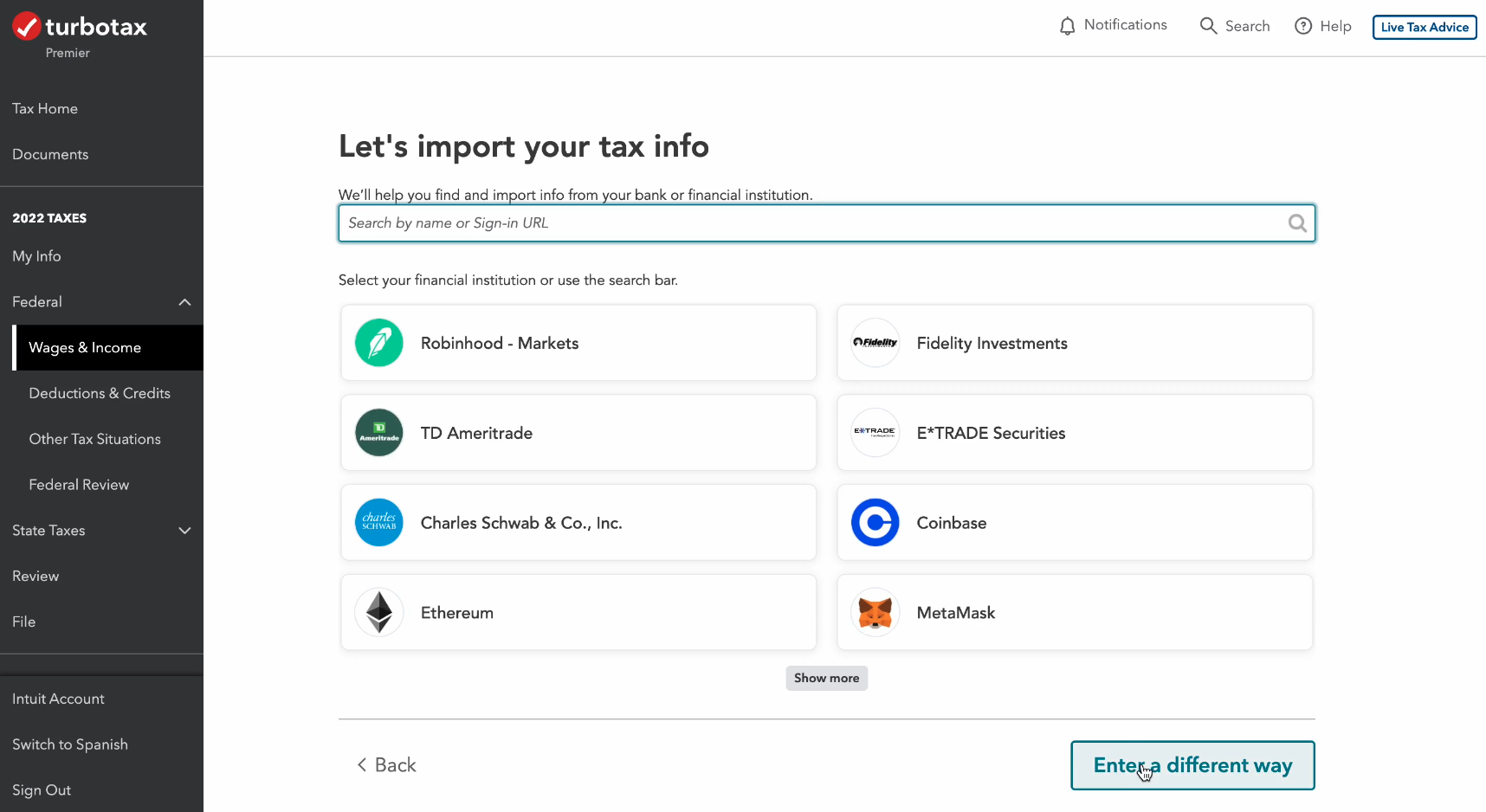

3. On the “Let’s import your tax info” screen, select “Enter a different way.”

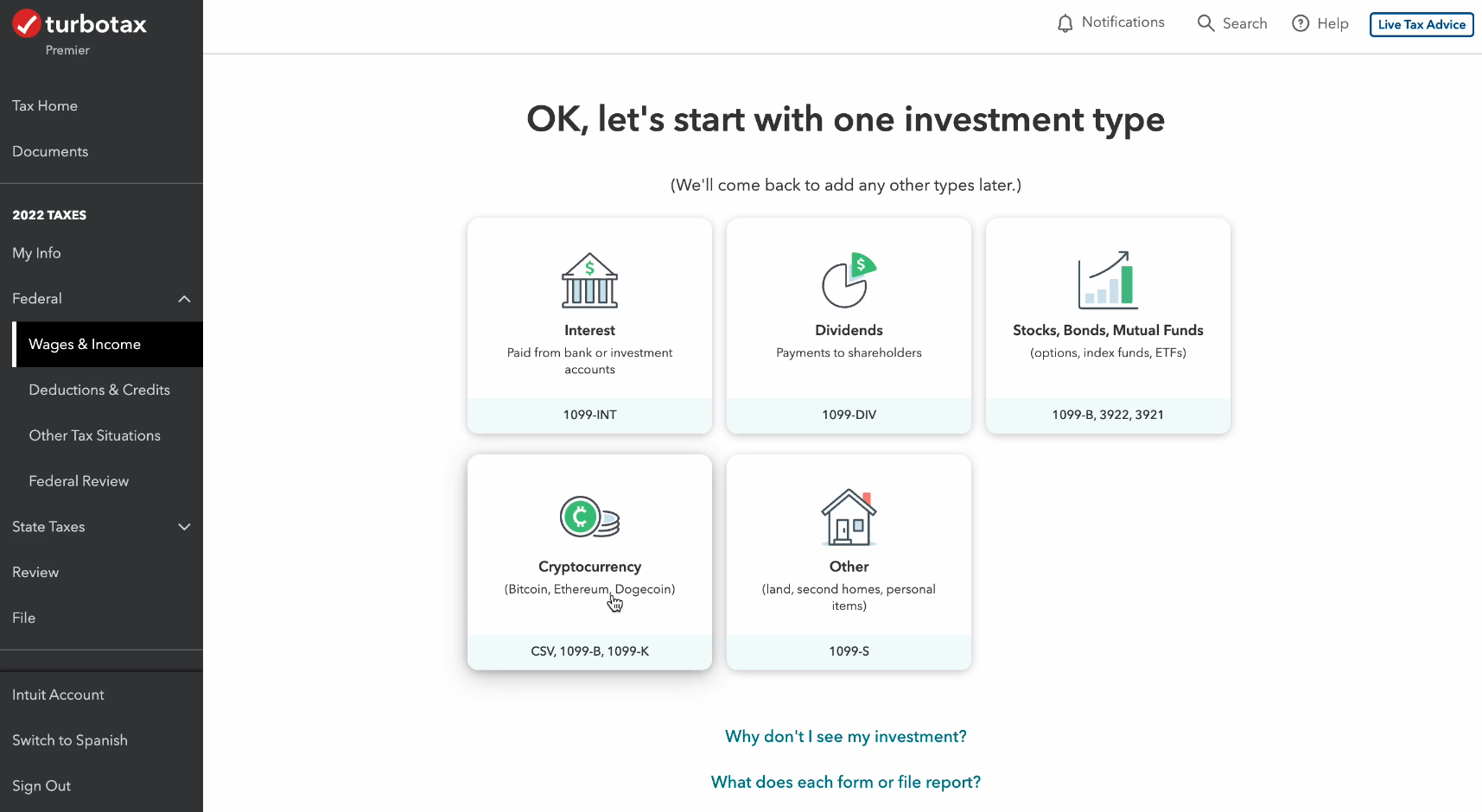

4. You'll now see a page with the header "OK, let's start with one investment type." Select “Cryptocurrency” and click “Continue.”

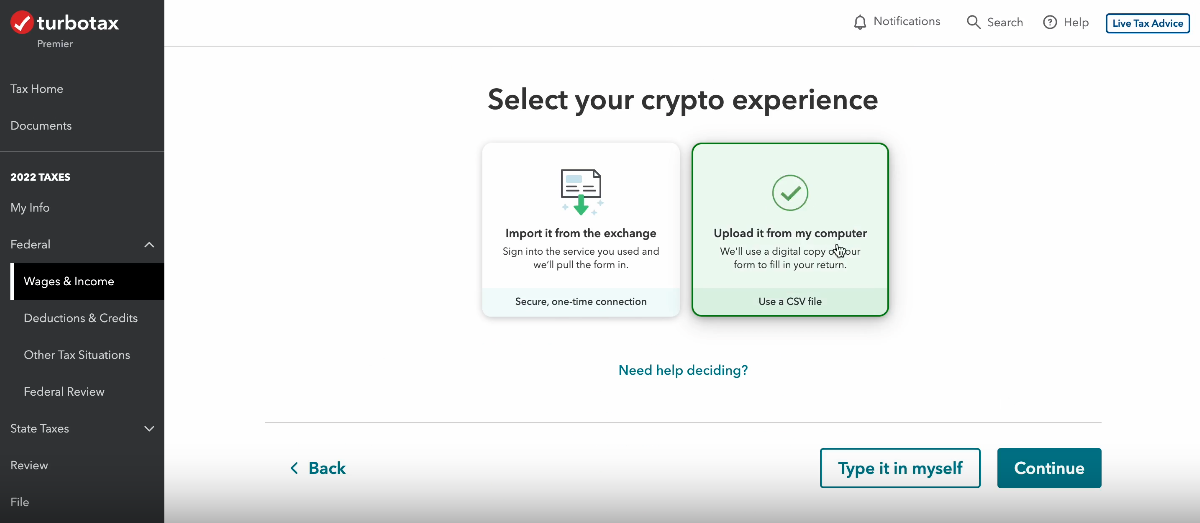

5. On the "Select your crypto experience" page, select "Upload it from my computer" and click "Continue."

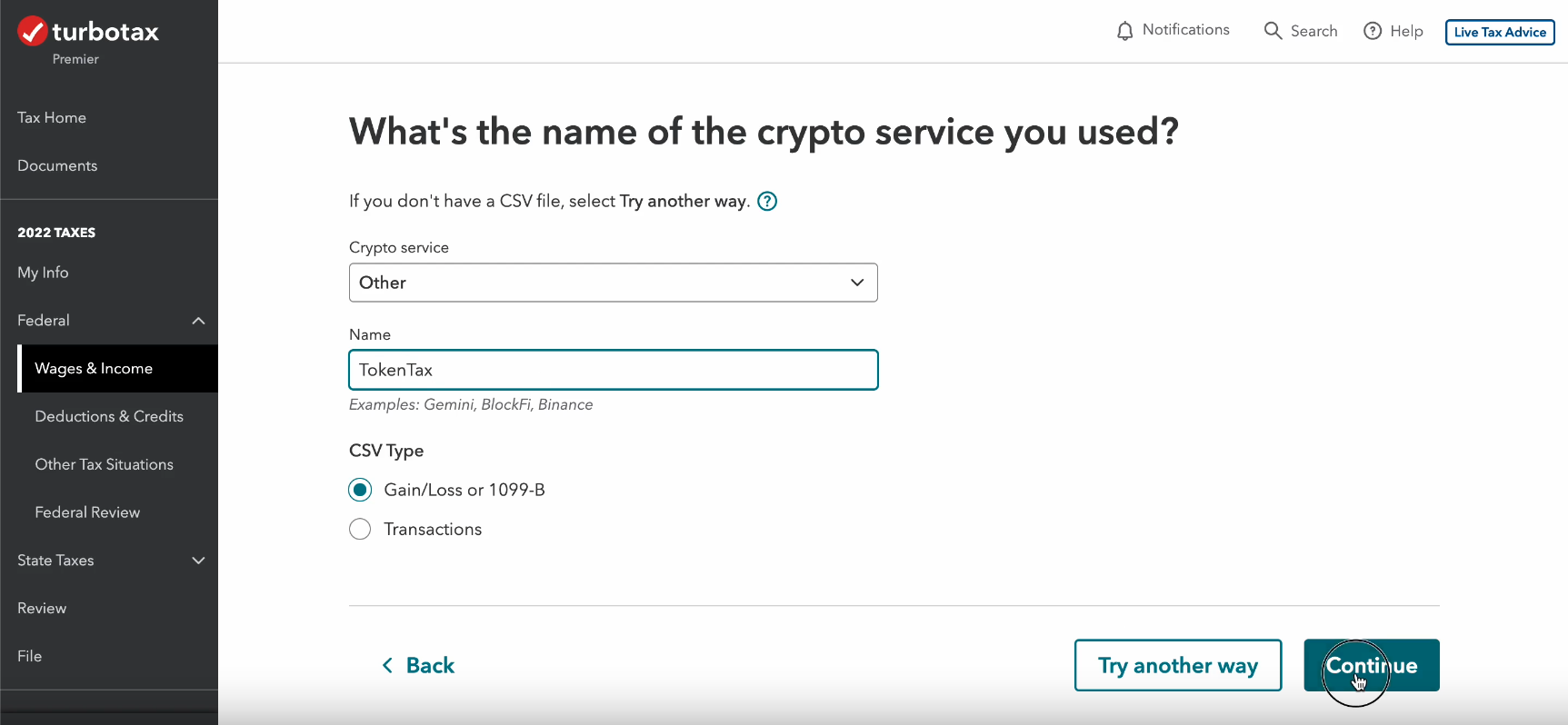

6. You'll now see a page asking, "What's the name of the crypto service you used?" Select "Other.” Enter “TokenTax” in the “Name” field and select “Gain/Loss or 1099-B” as the “CSV Type.” Click “Continue.”

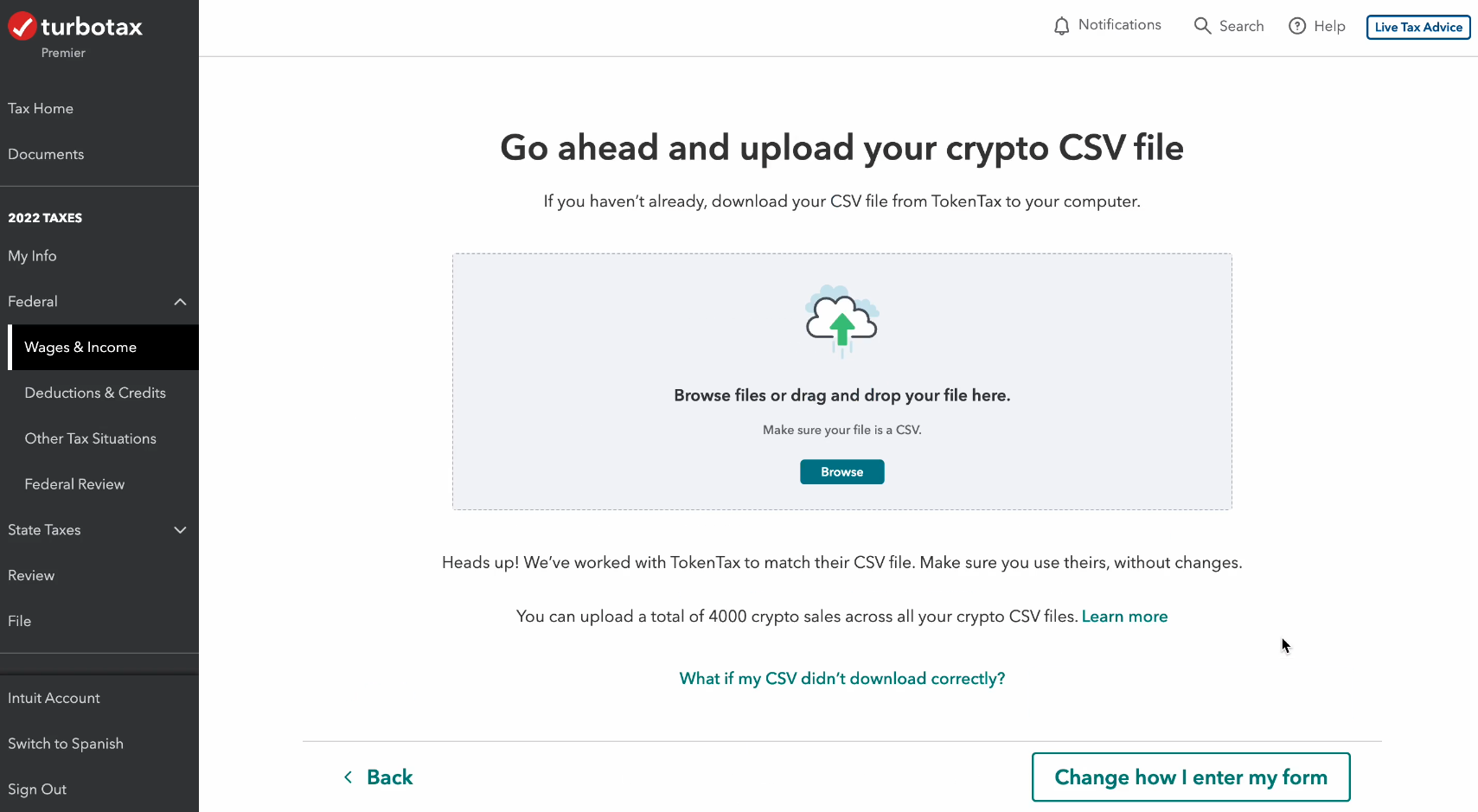

7. Upload your Form 8949 TurboTax CSV on the “Go ahead and upload your crypto CSV file” page. You’ve now imported your “Crypto (Gain/Loss)” report from TokenTax to TurboTax.

How do I report ordinary crypto income with TurboTax (not capital gains/losses)

The instructions given help you report capital gains and losses, so if you've earned cryptocurrency income in other ways, you'll need to report these earnings separately.

Presently, TurboTax doesn't support direct reports of staking, mining, or other types of crypto income. To report this, follow these steps:

In TokenTax, generate a report for your cryptocurrency income from staking, mining, interest, wages in crypto, etc., during the tax year.

In TurboTax, navigate to "Federal" -> "Wages & Income" -> "Less Common Income" -> "Miscellaneous Income, 1099-A, 1099-C." Click "Start."

Include your ordinary crypto income here.

How to report mining, staking, or airdrops on TurboTax

As noted, if you've earned crypto from Bitcoin mining, DeFi staking or rewards, airdrops, or hard forks it will not be reported on your crypto Form 8949. This is because it is taxed as ordinary income, not capital gains. The process for reporting crypto income depends on your personal filing situation, so we recommend contacting a crypto tax accountant.

However, if you received a Form 1099-MISC for staking and rewards from an exchange like Coinbase, do the following:

Navigate to your "Wages & Income" screen in TurboTax.

Scroll until you find "Other common income." Click “Show More" and then find "Form 1099-MISC." Click “Start." Follow the instructions to transfer the data from your 1099 into TurboTax.

Use a crypto tax software to file with TurboTax

Let’s look further at how to report crypto on TurboTax without hassle or mistakes. When paired with our platform at TokenTax, TurboTax makes crypto tax filing easy. TokenTax is both crypto tax calculation software and a full-service crypto tax accounting firm, so if you have any questions or concerns, our experts are available to assist.

To prepare your TurboTax crypto filing with TokenTax, simply visit the Documents tab of your TokenTax dashboard. Click the "Create Report" button on the right side of the screen, find "Form 8949 TurboTax CSV," and click "Generate Report." Your report will appear in your Downloads folder, and you can use this with TurboTax for speedy filing.

Our team of crypto tax professionals is available to assist if you have any questions or concerns about TurboTax cryptocurrency filing.

Schedule a FREE crypto tax consultation

Help! TurboTax says I have too many transactions on my Form 8949

If you've conducted more than 4,000 transactions in the last tax year, TurboTax may reject your e-file. You will need to submit your summary totals to TurboTax instead. If you're a TokenTax user and you need a summary capital gains file for TurboTax, contact our live chat support and ask for an aggregated TurboTax CSV. This will allow you to import just your summarized short and long-term gain/loss to TurboTax. Only use this option if you are mailing the complete 8949 separately with Form 8453.

Then, within three days of your e-file being accepted by the IRS, you will need to physically mail your full Form(s) 8949 and the IRS Form 8453 generated by TurboTax to the following address:

Internal Revenue Service

Attn: Shipping and Receiving, 0254

Receipt and Control Branch

Austin, TX 73344-0254

How to import crypto data into TurboTax CD/Download/Desktop

Note: TurboTax's CD/Desktop/Downloaded edition does not officially support cryptocurrency. We recommend you use the web version for the best cryptocurrency tax support.

However, it is possible to include your crypto with your tax return via the TurboTax Desktop/CD/Downloaded edition. In this case, the transaction limit is 10,000.

If you are above 10,000 transactions, refer to the instructions above for sending in your 8949 separately.

How to import your transactions into TurboTax CD/Desktop/Download

In your TokenTax "Documents" screen, create and download a Form 8949 TXF.

On TurboTax, select "File -> Import -> From Accounting Software (Windows)

or "File -> Import -> From TXF Files (Mac)."Select "Other Financial Software (TXF file)" and click "Continue."

Select the TXF file you saved from TokenTax and click "Import Now."

Click "Done" on the next screen.

To review the added information, go to "Personal -> Personal Income" and scroll down to "Investment Income."

For more info on crypto tax basics, visit our crypto tax guide.

Frequently asked questions

Here are some common answers to frequently asked questions about how to report crypto on TurboTax.

Does TurboTax calculate crypto gains?

Yes. TurboTax Premier guides users through cryptocurrency transactions and allows the import of up to 20,000 cryptocurrency transactions at once, calculating gains and losses.

How do I format my cryptocurrency transactions into CSV format for TurboTax?

TurboTax has comprehensive instructions to import cryptocurrency transactions via CSV, with a template, and supports CSVs from Coinbase, PayPal, CashApp, and Binance US. TokenTax also exports CVS documents you can use for TurboTax cryptocurrency.

Where is the crypto tax question on TurboTax?

After the initial prompts in TurboTax, you'll see an option to select “I Sold Stock, Crypto, or Other Investments.” To find the TurboTax cryptocurrency section of the app, visit the “Federal” tab and choose “Wages & Income.”

How long does TurboTax take?

The length of time it takes to file with TurboTax depends on the complexity of your returns, but you should set aside a few hours for the process. Upon filing, your return is sent to the IRS the same day, and it normally takes a week to ten days to receive a refund.

How much does TurboTax online cost?

TurboTax offers a range of options, including a free version for basic filing. To file crypto returns with TurboTax, you'll want TurboTax Premier, which starts at $89 for federal filing.

To stay up to date on the latest, follow TokenTax on Twitter @tokentax.