Does Coinbase Report to the IRS?

TokenTax content follows strict guidelines for editorial accuracy and integrity. We do not accept money from third party sites, so we can give you the most unbiased and accurate information possible.

Coinbase reports relevant tax-related information to the IRS to comply with regulations. Specifically, it submits Forms 1099-MISC to the IRS for US traders who earned more than $600 in crypto rewards or staking during a given year.

If you're a US taxpayer and use Coinbase but have not met the $600 threshold, this doesn't exempt you from needing to report all cryptocurrency earnings on your tax return. Regardless of whether a user receives official tax documents, full disclosure of crypto income is still required.

How are my Coinbase transactions taxed?

Crypto transactions on Coinbase are taxed just like any other crypto transaction. Under certain circumstances, Coinbase does report to the IRS, but that does not mean the individual taxpayers is not responsible for reporting. Coinbase's reports to the IRS can include forms 1099-MISC for US traders earning over $600 from crypto rewards or staking in a given tax year.

These tax forms do not report capital gains or losses. See our article on how to report cryptocurrencies on taxes for general information about reporting crypto taxes.

Note, too, that in 2022, Coinbase retired Coinbase Pro and moved those features to "Advanced Trade."

What information does Coinbase send to the IRS?

Coinbase sends a copy of each crypto tax form to both the taxpayer and the IRS, so if you've received a Coinbase 1099, the IRS has as well and will expect you to file taxes on your cryptocurrency income.

Gain/loss report

The Coinbase 1099 tax document does not report crypto capital gains or losses, but that doesn't mean you don't need to report them. A Coinbase 1099 signals to the IRS that a user is actively trading crypto and may have transactions other than rewards or staking to report. The platform does have a gain/loss report but does not report your gains or losses to the IRS.

Raw transaction report

Coinbase does not provide a raw transaction report to the IRS. That said, you can access your raw transaction report via Coinbase and Coinbase Taxes, with a range of available gain/loss reports. Raw transaction history can be found through custom reports.

TokenTax automatically generates the tax forms and reports you need.

What does the IRS do with tax documents?

In recent years, the IRS has increased their crypto tax audits and enforcement. They are sending letters 6173, 6174, and 6174-A or even CP2000 notices. 1099-K and 1099-MISC data help the IRS identify filers who may be failing to report or under-reporting.

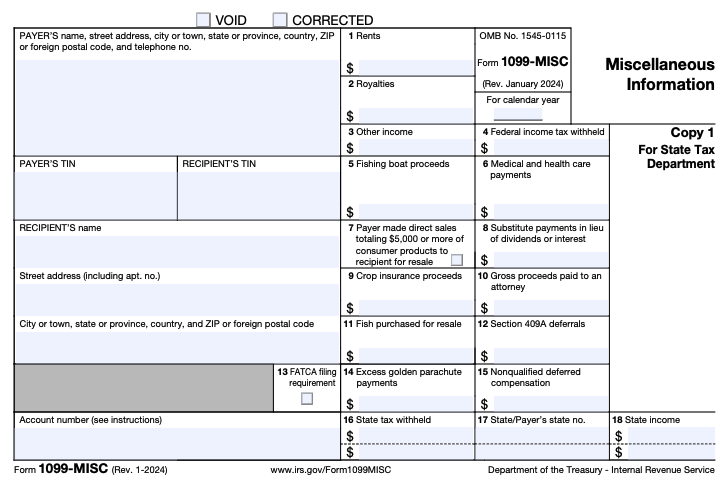

What are 1099 forms?

A 1099 tax form is a record that an entity or person who is not your employer has paid or given you money. Here are three common 1099 forms:

Form 1099-K: This form is commonly used by credit/debit card networks and other payment settlement networks. The form shows the IRS the transaction volume of processed payments. Per the IRS: "... the IRS is planning for a threshold of $5,000 for tax year 2024 as part of a phase-in to implement the $600 reporting threshold enacted under the American Rescue Plan (ARP)."

Form 1099-MISC: This form reports ‘miscellaneous’ income to the IRS. Rewards from referrals and staking would fall into this ‘miscellaneous’ category.

Form 1099-B: This form is used to share information about property/security disposals made through a broker. You may be familiar with this form if you’ve used stock exchanges like Robinhood or E-Trade.

What do I need to do if I receive a 1099-MISC from Coinbase?

The 1099-MISC doesn’t report individual transactions from staking or rewards, just your total income from them. You are required to report the details—as well as any crypto capital gains, losses, or ordinary income from any exchange—in order to calculate your crypto taxes. A crypto tax calculator can help with this. For more information on the 1099-MISC visit our post about cryptocurrency Form 1099s.

Why did Coinbase switch from Form 1099-K to Form 1099-MISC?

Before 2021, the exchange sent Forms 1099-K. However, because Form 1099-K reports the aggregate amount of crypto involved in an individual’s trades, rather than the net profits or loss, it was easy for transactions that ultimately represented a loss to be interpreted as generating revenue.

1099-K form example

For example, imagine you purchased a token for $1.00, but sold it later in the same year for only 75 cents. Despite the fact that this series of transactions represented a 25 cent loss, $1.75 would be reported as part of the amount on the 1099-K.

This situation can lead to confusion at the IRS. Agents sometimes interpret 1099-K calculations as crypto traders’ profits, rather than their trades’ volume.

This may result in the IRS sending CP2000 letters, which inform filers they may have significantly under-reported their income on their tax filings. To address such misunderstandings usually requires the intervention of a crypto CPA.

Although IRS misinterpretations of the 1099-K are typically resolved, their effect on customers was burdensome enough to prompt Coinbase and other crypto exchanges to stop sending these tax forms.

Does Coinbase send a 1099-B?

The short answer is no. At time of writing, Coinbase only reports Form 1099-MISC to the IRS. This information is subject to change, so be sure to look for updates.

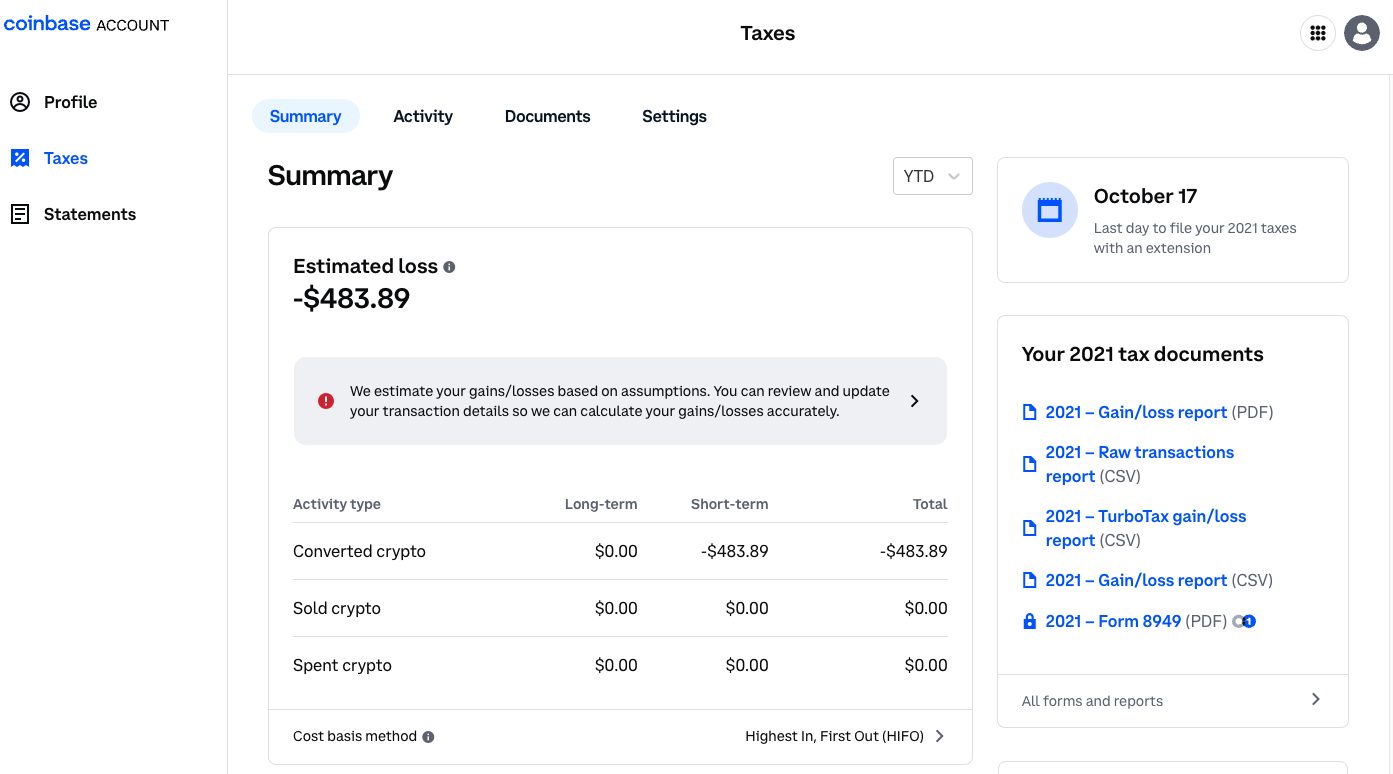

Accessing your Coinbase tax documents

Even if you don't receive a 1099-MISC from Coinbase, you need to report any income or capital gains/losses you've realized on the exchange. Many crypto tax calculators, TokenTax included, can sync to Coinbase via API so that transaction history is automatically imported and updated.

However, if you need to download a copy of your transaction history for record-keeping or your accountant, you can do so by visiting the Taxes section of your account. Here you can download gain/loss reports and raw transaction history CSVs. You can also see if Coinbase has issued any forms about you to the IRS.

Schedule a FREE crypto tax consultation

Does Coinbase report to IRS FAQs

Here are some common FAQs related to Coinbase IRS reporting, the Coinbase 1099, and Coinbase taxes and tax documents.

Am I required to pay taxes on Coinbase transactions?

Yes. US taxpayers must report and pay taxes on pertinent Coinbase transactions to the IRS, including crypto earned from various programs and staking, as well as sales of crypto for fiat or other forms of crypto. Our crypto tax software at TokenTax makes it easy for you to report and comply with all of your crypto tax obligations.

Will Coinbase send me a 1099?

$600 is the current Coinbase IRS reporting threshold. Currently Coinbase sends form 1099-MISC for users who are U.S. traders who made more than $600 from crypto rewards or staking in the last tax year. You can also access tax documents through the mobile app.

Do all crypto exchanges report to the IRS?

No, every cryptocurrency exchange does not report to the IRS. Many exchanges are based internationally and do not do business in the United States. That said, if you’re in the United States or are a United States citizen, you are responsible for reporting your crypto transactions to the IRS.

Can the IRS see my crypto wallet?

Crypto wallets interact with publicly visible blockchains, so yes, the IRS can “see your crypto wallet.” That said, depending on the wallet and the nature of your transactions, it’s possible the IRS cannot correlate a specific wallet with you as a user. That noted, Coinbase runs a KYC (know your client) process and analytics firms like Chainalysis have working partnerships with the Federal Government.

So it’s fair to assume you can’t (and obviously should not) “hide” your crypto transactions from the IRS, as of course you need an on- and off-ramp to bring fiat into and out of your crypto wallet. This is almost always done through a centralized exchange like Coinbase, which of course reports to the IRS.

What happens if you don't report Coinbase taxes?

If you don’t report Coinbase taxes, you could get in trouble with the IRS and receive a Failure to File penalty. This penalty begins at 5% of the unpaid taxes for each month (or part of a month) your tax return is late, not to exceed 25% of unpaid taxes.

If the IRS determines an overt act of evasion occurred, willful failure to file could be treated as a felony. So you’ll definitely want to report Coinbase taxes.

How do I avoid Coinbase taxes?

A simple way to avoid Coinbase taxes is to purchase and hold without exchanging or selling. Other options to avoid or reduce crypto taxes include:

Sell assets during a low-income year

Donations to charity

Offset your gains with losses

Like any other income, however, if you have significant gains through Coinbase, you’ll need to properly file them as part of your tax return. For more info on crypto tax basics, visit our crypto tax guide.

Does Coinbase give a 1099?

Coinbase sends Forms 1099-MISC to the IRS and to traders who made more than $600 in crypto rewards or staking. $600 is the current Coinbase IRS reporting threshold. This may be subject to change in future years.

Do I have to pay taxes on Coinbase?

Yes, taxpayers are responsible for taxes on crypto exchange activity whether or not they've received a 1099 and must report their activity when filing taxes.

There is no way to entirely avoid tax consequences from your Coinbase activity. That noted, there are ways to legally reduce your crypto taxes and develop a crypto trading strategy to minimize your tax obligations. See How to Reduce Crypto Taxes for further guidance.

What should I do if I don't receive a 1099 from Coinbase?

Even if you don't receive a 1099-MISC from Coinbase, you are still required to report any income or capital gains/losses on your taxes. Failure to report this income could lead to penalties from the IRS.

How can I ensure compliance with IRS regulations for Coinbase transactions?

To ensure compliance with IRS regulations, it's important to accurately report all Coinbase transactions, including earnings from rewards, staking, and cryptocurrency sales. Using crypto tax software like ours at TokenTax can help streamline the reporting process and keep you informed about changes to tax laws and reporting requirements.

What should I do if I receive a CP2000 notice from the IRS?

If you receive a CP2000 notice from the IRS concerning your Coinbase transactions, it's essential to address it promptly and accurately. Review the notice carefully to understand the discrepancies identified by the IRS. Gather supporting documentation, such as transaction records and tax forms, to substantiate your tax filings. Seek assistance from a crypto tax professional to respond to the notice and resolve any issues with the IRS efficiently.

To stay up to date on the latest, follow TokenTax on Twitter @tokentax.