FBAR for Crypto (Regulations for 2024)

TokenTax content follows strict guidelines for editorial accuracy and integrity. We do not accept money from third party sites, so we can give you the most unbiased and accurate information possible.

US taxpayers must file an FBAR for crypto if they have maintained an overseas crypto account that also contains currency worth $10k or more at any point during the previous year.

US investors and businesses whose overseas crypto value exceeded the FATCA reporting threshold during the previous year may file Form 8938 with the IRS to report foreign crypto holdings.

What is the FBAR?

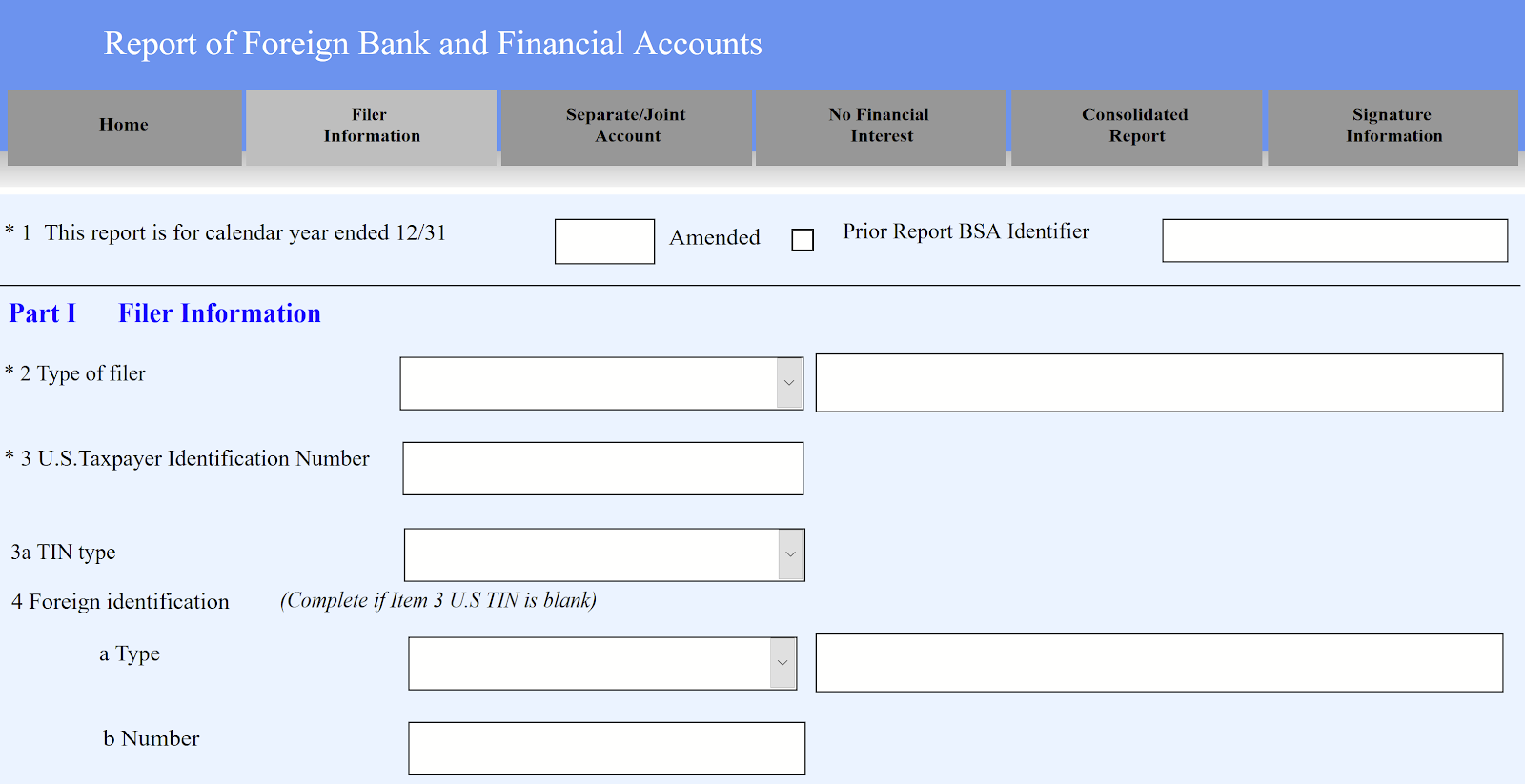

FBAR is another name for FinCEN Form 114, which was previously called the Report of Foreign Bank and Financial Accounts.

The FBAR is designed to track foreign financial assets to prevent crimes like tax evasion. It requires any US trader who held $10,000 or more in one or more foreign bank accounts during the tax year to report the balances of said accounts.

Although it has tax implications, the report itself is not made to the IRS but rather to the US Treasury Department through the Bank Secrecy Act's e-filing system.

Do you report crypto on FBAR?

According to current Financial Crimes Enforcement Network (FinCEN) directives, US taxpayers at this time are only required to disclose cryptocurrency information on an FBAR in 2024 if crypto is maintained within an overseas account that also contains assets subject to reporting.

For example, if a US taxpayer converts cryptocurrency into foreign currencies housed in an identical account (and the aggregate value of these foreign currencies surpassed $10,000 at any point in the previous year), the taxpayer would be obligated to declare the complete account value, including cryptocurrency holdings.

What is the deadline for filing my FBAR?

Per the IRS and FinCEN, annual FBAR reporting is due the same day as the regular tax deadline: typically April 15 of 2024. Taxpayers are permitted an automatic extension to October 15 and do not need to request an extension to file the FBAR.

Is a cryptocurrency FBAR required?

As noted, the FBAR is required for US taxpayers with joint currency and crypto accounts worth over $10,000 at any point in the previous year. While this affects a relatively small number of cryptocurrency investors and businesses, the obligation to submit IRS Form 8938 has a broader scope.

This obligation, established under the Foreign Account Tax Compliance Act (FATCA), encompasses a wider range of "foreign financial assets" beyond just offshore accounts.

Although the IRS has not yet issued definitive guidance on how FATCA pertains to cryptocurrency assets held overseas, it seems probable that cryptocurrency aligns with the definition of a foreign financial asset as outlined in the statute.

Consequently, investors and businesses whose cryptocurrency holdings exceeded the FATCA reporting thresholds must disclose these holdings to the IRS using Form 8938. The conservative approach here is to file. When in doubt, our crypto tax experts are available to assist.

FATCA reporting thresholds and reporting

The rules for reporting foreign financial assets depend on your filing status and whether you live abroad. If you're single or file separately, you need to fill out Form 8938 if the total value of your foreign financial assets is over $50,000 while in the US or over $200,000 if you live abroad. For those filing jointly, these thresholds double.

Living abroad means you're a US citizen with your tax home in a foreign country, and you've spent at least 330 days in a foreign country within 12 months.

If you're abroad and married, you must file Form 8938 if your combined foreign financial assets are over $400,000 at the end of the tax year or over $600,000 at any time during the year, even if only one spouse lives abroad.

Those living in the US must file if they are unmarried and their foreign financial assets exceed $50,000 at the end of the tax year or $75,000 at any time during the year. If you're married and filing jointly, the thresholds are $100,000 at the end of the tax year or $150,000 at any time during the year.

If married and filing separately, include one-half the value of jointly owned assets when calculating the thresholds. If you meet the filing requirements, report the entire value on Form 8938.

How to file a crypto FBAR in four easy steps

Here are four, simple steps showing how to file an FBAR. When in doubt, our crypto tax professionals at TokenTax can assist.

1. Use crypto tax software to organize your transactions

If you’ve traded on multiple exchanges, it may be helpful to use crypto tax software to aggregate and organize all your accounts so you can determine if and what you need to report.

If you are using TokenTax and have access to our FBAR feature, you will receive a report that tells you what the highest balance you had in foreign accounts was during the last tax year.

If you are already a Basic or Premium user and need to purchase the FBAR add-on, you can do so at the checkout page. Be sure that you've uploaded all your crypto data, including deposits and withdrawals for all exchanges. You can then generate the FBAR form in your Documents page.

2. Fill out your personal information on FinCEN's e-filing site

Individuals can use the Bank Secrecy Act (BSA) e-filing system to report their FBAR.FBARs should be filed by the April 15 tax deadline or by the October 15 tax extension deadline.

If an investor fails to file by April 15, they'll be granted an automatic extension, so there’s no need to file for any kind of FBAR extension.

In Part I of the e-filing process, fill out your personal information.

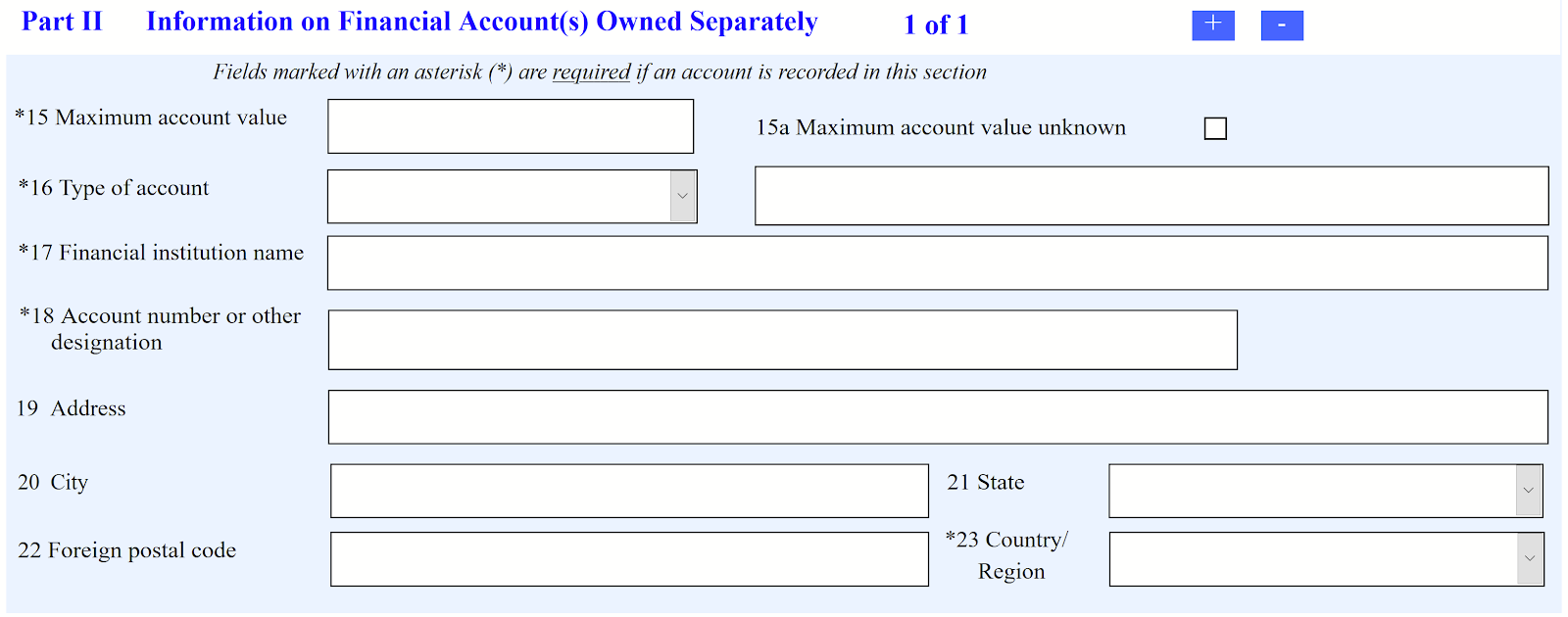

3. Provide information about the foreign crypto exchanges you've used

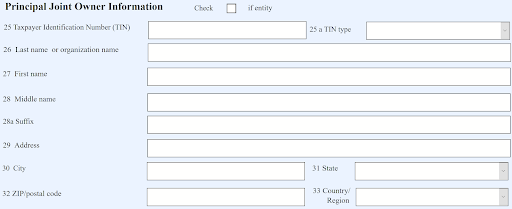

In either Parts II or III, you will provide information about the foreign exchanges on which you hold cryptocurrency. If you are a single filer, then fill out Part II. If you are completing the FBAR for jointly held accounts where both individuals have signature authority, then use Part III.

If you need to report multiple exchanges you can create copies of the form by clicking the + box at the top of the form in Pt II or III.

4. Enter the account balance details for each exchange

For each exchange, here's how we fill typically fill out the FBAR for TokenTax customers:

On the top row of your TokenTax-generated FBAR report, you'll see the maximum account value. Enter this in the applicable field on the BSA e-filing site.

For "Type of account," select "Other" and then in the box to the right, type in "Cryptocurrency exchange."

For "Financial institution name," enter the name of the exchange.

For "Account number or other designation, " enter the email address used for the exchange login.

For the exchange's physical address, fill it out to the best of your ability. Some exchanges share their addresses, while others keep them secret for security reasons. At a minimum, the exchange's country should be entered. You can find a list of popular foreign exchanges' countries below.

Parts IV and V are typically left blank.

Finally, add your signature to the document and submit.

Consult FinCEN’s instructions or a crypto tax accountant for more support on filing the FBAR.

What do I need to file the FBAR?

Per the IRS, for every account requiring an FBAR report, taxpayers are required to maintain records containing the following details:

Account holder's name

Account number

Foreign bank's name and address

Account type and highest value reached within the year

The legislation does not stipulate a specific document type to accompany this information. Documents such as bank statements or a duplicate of a submitted FBAR with the necessary details could suffice.

Typically these records should be retained for a period of five years from the FBAR's due date.

What is the Form 8938?

The 8938 is similar to the FBAR. It is a form that is reported to the IRS on your tax returns, while the FBAR is filed with FinCEN. The 8938 also has different, higher reporting thresholds, as set in the Foreign Account Tax Compliance Act (FATCA).

Read the IRS’s summary of FATCA reporting here for more information. Note that if you file a Form 8938, you may still need to file an FBAR as well. For more detailed information on the differences between the two forms, the IRS provides a table comparing Form 8938 and the FBAR.

Is a Form 8938 required for cryptocurrency?

The IRS has not given specific guidance regarding whether the FATCA applies to crypto held with foreign financial entities like cryptocurrency exchanges, but there’s no drawback to filing just in case. Many taxpayers are choosing to adhere to the FATCA requirement for digital assets in case later guidance requires crypto holders to file the 8938.

Who needs to file an FBAR?

FBAR obligations extend beyond American citizens and encompass "US persons," a category encompassing:

US citizens

US green card holders

Immigrants to the US with legal status

Partnerships and corporations established under US jurisdiction

Trusts featuring at least one trustee classified as a US person

Per the IRS, any of these US persons must file an FBAR to report if:

They have a financial interest in or signature or other authority over at least one financial account located outside the United States and if:

The aggregate value of those foreign financial accounts exceeded $10,000 at any time during the calendar year reported.

What happens when I don’t file my FBAR?

Per a 2023 Supreme Court ruling, the IRS can impose penalties for non-willful violations of "FBAR" reporting, calculated per report rather than per account. This recent Supreme Court decision brings clarity to taxpayers preparing voluntary disclosures or in discussions with the IRS about prior violations.

Those facing such penalties should ensure not exceeding $10,000 per filed FBAR report in settlement talks. The ruling might also trigger more legal disputes over the line between deliberate and non-deliberate filing failures.

In case of willful violations, potential fines encompass $100,000 or half of the peak value of the accounts—whichever of the two is higher.

The IRS has the authority to levy these penalties for each year that goes without filing. Willful failure to file FBARs over three years could mean fines of $300k or more.

How TokenTax can help filing your FBAR

TokenTax simplifies the process of filing your FBAR as part of our comprehensive crypto tax solutions. Our crypto tax professionals are available to help you with all aspects of your crypto tax needs, ensuring accurate and complete filings regardless of how you use crypto or where you report taxes.

Here are some of the ways we make crypto tax filing easy:

1. Easy Data Import

Sync your data seamlessly by connecting TokenTax to your wallets and accounts. This integration minimizes manual data entry, allowing you to consolidate and analyze all your crypto-related information in a single location. Our system supports various integrations, including those for DeFi, NFTs, margin and futures trading.

2. Tax Reports

Gain real-time insights into your tax liability with our comprehensive tax reports. These reports encompass multiple tax calculation methods, such as FIFO, LIFO, Minimization, and average cost. Additionally, you can access features like tax loss harvesting dashboards, mining and staking income reports, and Ethereum gas fee reports.

3. Crypto Tax Forms

Our software automatically generates all the necessary tax forms, including Form 8949, Schedule D, and FBAR. These forms are crucial for completing your tax filings accurately, whether you choose to file with TokenTax or use another provider like TurboTax.

4. Reconciliation

For investors with more intricate accounting needs, we offer advanced reconciliation services handled by knowledgeable crypto tax professionals. We're equipped to manage complex scenarios, such as missing cost basis data, high transaction volumes, and cross-chain transactions.

5. Enterprise Solutions

If you require enterprise-level crypto tax solutions, we have tailored options available to meet your specific needs.

Ready to get started? Explore our plans and pricing to determine the best solution for your individual requirements. With TokenTax, you can streamline your FBAR filing process and ensure accurate compliance with crypto tax regulations.

Schedule a FREE crypto tax consultation

Which exchanges are not US based?

You'll need to know which exchanges qualify as foreign financial institutions if you file an FBAR. Here is a list of some of the exchanges outside of the United States.

Common foreign exchanges

Bibox (Singapore)

Binance (Malta)

Bitfinex (Taiwan)

Bitflyer (Japan)

Bithumb (South Korea)

BitMEX (Seychelles)

Bitstamp (U.K.)

BTC Markets (Australia)

Bybit (Singapore)

CEX.IO (U.K.)

Coss (Singapore)

Deribit (Netherlands)

Gate.io (Cayman Islands)

HitBTC (Hong Kong)

Huobi (Singapore)

KuCoin (Hong Kong)

Mercatox (U.K.)

OKEx (Malaysia)

The Rock Trading (Italy)

Tidex (Russia)

Uphold (U.K.)

Yobit (Russia)

Common US exchanges that do not need to be included on the FBAR

Here is a list of the most common US based exchanges. These do not need to be included on the FBAR.

Bittrex

Cash App

Circle

Gemini

itBit

Kraken

Poloniex

DeFi exchanges

Because DeFi exchanges are not registered in any country, it is unlikely that a US trader would need to include them in FBAR or Form 8938 filing.

Frequently asked questions about FBAR for crypto

Here are answers to frequently asked questions about FBAR for crypto, how to file FBAR, and the 8938 vs FBAR.

What is the FBAR, and who needs to report foreign financial accounts?

The FBAR, or FinCEN Form 114, previously known as the Report of Foreign Bank and Financial Accounts, is designed to track foreign financial assets to prevent crimes like tax evasion.

US taxpayers, including citizen residents, who held $10,000 or more in one or more foreign bank accounts during the tax year are required to report the balances of these accounts. The report is not made to the IRS but rather to the US Treasury Department through the Bank Secrecy Act's e-filing system.

Do I need to report joint ownership on an FBAR for crypto?

Yes, if accounts are jointly owned, you need to report all owners. On the FBAR, there is a separate space for this information, so you do not need to provide additional reports.

How do I report cryptocurrency to the IRS?

US taxpayers must declare all gains and losses from cryptocurrency transactions on Form 8949 and Form Schedule D. Additionally, incorporate any standard taxable income from crypto activities onto either Schedule 1 of Form 1040 or Schedule C if your income originates from self-employment. Attach each relevant form to your Individual Income Tax Return Form 1040.

What happens if I don't report cryptocurrency on taxes?

Failure to report crypto on your taxes can have significant repercussions. The exact outcomes differ based on your jurisdiction, but in general, it's crucial for taxpayers to accurately report cryptocurrency to avoid penalties, interest accrual, and potentially even criminal allegations.

Is crypto subject to FBAR?

Crypto is subject to FBAR reporting if it is held in foreign accounts alongside other assets subject to reporting if the aggregate value of these assets exceeds $10,000 at any point during the tax year.

Does FATCA apply to crypto?

While the IRS has yet to issue definitive guidance on how FATCA applies to crypto assets held overseas, crypto potentially aligns with the definition of a "foreign financial asset" outlined in the statute.

Investors and businesses whose crypto holdings exceeded the FATCA reporting thresholds the prior year must disclose these holdings to the IRS using Form 8938. When in doubt, consult with a crypto tax professional for guidance.

Does the IRS look at crypto?

Yes, the IRS looks at crypto, and taxpayers must report cryptocurrency transactions on their tax returns, including disposals and crypto received as income. Failure to report crypto income and capital gains can lead to penalties, interest accrual, and potential legal consequences.

Is cryptocurrency considered a foreign asset?

Cryptocurrency itself is not inherently considered a foreign asset. However, if it is held in foreign accounts alongside other assets subject to reporting, it becomes part of the aggregate value that determines FBAR and FATCA reporting requirements.

To stay up to date on the latest, follow TokenTax on Twitter @tokentax.