Guide to Crypto Taxes in the United Kingdom for 2024

TokenTax content follows strict guidelines for editorial accuracy and integrity. We do not accept money from third party sites, so we can give you the most unbiased and accurate information possible.

HMRC categorizes crypto assets into three types: exchange tokens (like Bitcoin), utility tokens, and security tokens. While the guidelines cover all types, the tax treatment for utility and security tokens may differ, though this distinction is not explicitly clarified.

UK taxpayers are subject to capital gains tax when disposing of crypto assets. From April 2024, you only pay capital gains tax on gains exceeding £3,000 (down from £6,000 the previous year). Different tax rates apply based on your income, ranging from 10% to 20%, and crypto gifts to individuals other than spouses or civil partners may also incur capital gains tax for the recipient.

HMRC (His Majesty's Revenue and Customs) has released fairly comprehensive guidelines for filing taxes on cryptocurrency in the UK. The tax regulations cover crypto trading, payments, income, mining, gifts, and business activity.

Intro to UK crypto taxes

HMRC defines three types of crypto assets: exchange tokens (currency coins like Bitcoin), utility tokens (tokens issued by a business with utility uses), and security tokens (tokens that represent a form of equity in a company).

The guidelines apply to all forms of crypto, but it also acknowledges that for utility and security tokens, "different tax treatment may need to be adopted." However, they have not clarified yet that these different kinds of tokens are treated differently.

Crypto is not considered currency or money but rather an asset. HMRC recognizes that most individuals hold crypto as a personal investment and will pay capital gains tax when they "dispose" of the crypto — see below.

Do I need to pay crypto taxes in the United Kingdom?

You must only pay capital gains tax on overall gains above the annual exempt amount. The annual exempt amount changes from £6,000 to £3,000 effective April 2024.

Individual crypto activities that are taxable include:

Gains over £3,000 (cut from £6,000)

Income received from Bitcoin mining, airdrops, or DeFi rewards

Crypto received as salary

If an individual runs a business profiting from cryptocurrency trading, income tax rules take priority over capital gains.

Tax on individual capital gains or losses

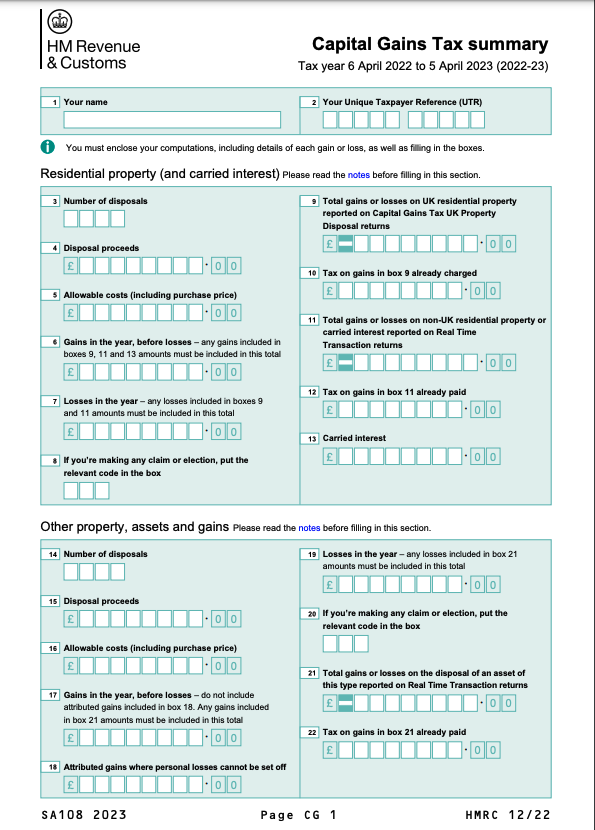

When disposing of crypto assets, you calculate gain or loss for capital gains tax. HMRC defines disposal as selling crypto for fiat, exchanging one cryptocurrency for another cryptocurrency, and giving away crypto to another person (as a gift or in exchange for goods or services). You report capital gains and losses on supplementary pages SA108 of your SA100 tax return.

Allowable costs can be deducted when calculating a crypto gain or loss, such as the original purchasing amount, transaction fees, and professional costs (i.e., cost of drawing up trade contracts or appraisal costs) in relation to buying or selling the assets.

Capital losses from crypto transactions can be considered for your tax liability. If crypto is disposed of for less than its allowable cost (i.e., sold at a loss), then the loss can be deducted to reduce the overall capital gain. You can also claim total losses for crypto if the value has dropped to zero or a minimal amount. Losses must be reported to HMRC.

Individual capital gains tax rates in the UK

Your capital gains tax rates depend on your income rate band.

| Income rate band | Capital gains tax rate |

|---|---|

| £12,571 to £50,270 (Basic rate income band) | 10% |

| > £50,270 to £125,140 (Higher rate income band) | 20% |

| over £125,140 (Additional rate income band) | 20% |

UK crypto gifts taxes

If you give someone crypto who is not your spouse or civil partner, the fiat value of the gift will be a capital gain for the recipient, even if the asset hasn't been cashed out.

Crypto donated to charitable organizations is not subject to capital gains tax unless the donation is more than the acquisition cost or unless the donation is tainted.

Share pooling rules and average cost basis accounting

Pooling practices applied to shares and securities also apply to crypto. Each token is kept in its own pool. The averages of the sums paid initially for that coin create the average cost basis, which fluctuates as more of that token is acquired or disposed of.

However, average cost basis accounting can be manipulated to minimize capital gains tax liability. Therefore, profiting from wash sales is disallowed by the HRMC by matching acquisitions and disposals of the same asset by the same person in the following order:

Tokens of the same crypto acquired and sold on the same day (Same Day Rule)

Tokens of the same crypto sold and reacquired within 30 days (30-Day Rule)

A single cost-averaged pool of the same crypto purchased before the disposal date (Section 104 or S104 holdings)

In the instance of a hard fork, any allowable costs stemming from the initial acquisition pre-fork will be split between the original and new forks.

Airdropped tokens go into their own pool unless the recipient already owns the same token. The value of the airdropped token does not come from an existing held crypto.

UK crypto taxes on mining, airdrops, or payments

If an individual mines crypto, receives an airdrop, or receives crypto for goods or services, those earnings will be subject to income tax, and the taxpayer will have to pay the national insurance contribution.

Income tax rates

| Taxable income | Tax rate |

|---|---|

| Up to £12,570 (Personal allowance) | 0% |

| > £12,571 to £50,270 (Basic rate income band) | 20% |

| >£50,271 to £125,140 (Higher rate income band) | 40% |

| over £125,140 (Additional rate income band) | 45% |

Note that UK income tax rates are different if you live in Scotland.

Fees and/or rewards from mining can either be income tax in the form of trading income or miscellaneous income, depending on the degree of activity, organization, and overall commerciality. Crypto assets received from these activities are subject to capital gains tax when their gains are realized. The costs for mining typically cannot be deducted.

Schedule a FREE crypto tax consultation

Taxes on staking and lending income

In 2022, the UK published new guidance on the tax treatment of earnings from staking and DeFi lending. Essentially, it said that how these assets are taxed should be determined on a case-by-case basis.[1] Some may be taxed as capital assets, while others may be income. The key determining question is whether the crypto is earned in exchange for a service (income) or from an increase in the value of an asset owned by a platform.

It provides the following list of factors to consider when determining how to report earnings:

Whether the expected return for the crypto lender or liquidity provider is established when the agreement is formed. If the return is predetermined, like a fixed 5% per annum, it is considered a revenue receipt. Conversely, if the return is uncertain and speculative, potentially resulting in a loss, it qualifies as a capital receipt.

The nature of the return also hinges on how it is realized. If the return is obtained through the sale of a capital asset, it falls under the category of a capital receipt. On the other hand, if the borrower or DeFi lending platform pays the return directly to the lender or liquidity provider, it is categorized as a revenue receipt.

The timing and frequency of return payments are crucial in determining its tax classification. A one-time payment is more likely to be treated as capital, whereas recurring payments over time are more likely to be categorized as income.

The duration of the lending arrangement, whether it is fixed or indefinite, short-term or long-term, can also influence its tax treatment.

Negligible value claims

In the event that a cryptocurrency becomes worthless and/or untradeable, a negligible value claim can be filed in order to treat the asset as disposed of, and thus losses can be claimed.

If you lose your private key, a negligible claim can be filed only if it can be proven that there is no chance of recovering the key.

In the instance of theft or fraud, one cannot claim a capital loss. The only instance where HMRC states a loss can be claimed is in the example of being sold a cryptocurrency that then becomes worthless. In this case, a negligible value claim can be filed.

Corporate crypto taxes

If you are operating a business, such as professional trading or Bitcoin mining, your crypto holdings may be taxed as income instead of capital gains.

However, HMRC is very strict on business considerations and will rarely consider an individual investor as a professional trader.

Record-keeping

HMRC recommends keeping separate, individual records for crypto transactions in the event that an exchange only keeps records for a limited amount of time or if an exchange shuts down before a tax return is completed.

Syncing your transaction history from all exchanges in a crypto tax calculator is one way to keep track of all of your data over multiple years with automated formatting in an organized fashion.

Any gain or loss must be converted to pound sterling for the tax return, even in crypto-to-crypto trades. HMRC says to use and keep a record of "consistent methodology" when making the pound sterling valuation.

Learn more about crypto taxes in our crypto tax guide.

Schedule a FREE crypto tax consultation

UK crypto taxes FAQs

Here are answers to frequently asked questions about crypto taxes in the United Kingdom.

How are crypto assets taxed in the United Kingdom?

Crypto assets in the UK are treated as assets, not currency. Individuals are liable to pay capital gains tax when they dispose of these assets. Disposal includes selling crypto for fiat, exchanging one cryptocurrency for another, or giving crypto as a gift or in exchange for goods and services.

Are there tax implications in the UK for receiving crypto as income, such as from mining or airdrops?

Yes, receiving crypto as income, whether from mining, airdrops, or payment for goods and services, is subject to income tax in the UK. The tax rates vary based on your income level, ranging from 0% to 45%. Additionally, the costs associated with mining typically cannot be deducted when calculating income tax, but capital gains tax may apply when you realize gains from these assets.

Do I have to report cryptocurrency holdings to HMRC if I haven't sold them?

No, you are not required to report cryptocurrency holdings to HMRC if they are simply held as an investment, as such holdings are considered tax-free.

Do I only need to pay taxes on cryptocurrency when I convert it to cash?

No, not exclusively. Selling is just one instance of a taxable event in the UK. You are also liable to pay taxes on profits when you exchange, spend, or gift cryptocurrency (excluding gifts to a spouse) in the UK. Furthermore, several crypto transactions may be subject to Income Tax upon receipt.

Is crypto taxed in England?

Yes. In England, crypto is treated as an asset, not currency, and individuals are liable for capital gains tax when disposing of these assets. This includes selling crypto for fiat, exchanging cryptocurrencies, or using crypto for transactions. Tax obligations also apply to receiving crypto as income from mining, airdrops, or payments for goods and services, subject to varying income tax rates. It's important to stay informed about HMRC guidelines to ensure compliance with crypto taxation in England.

To stay up to date on the latest, follow TokenTax on Twitter @tokentax.

Related Content

References

Last reviewed by Tynisa (Ty) Gaines,EA on April 24, 2024 · Sources