The Essential Guide to Crypto Tax in Japan for 2024

TokenTax content follows strict guidelines for editorial accuracy and integrity. We do not accept money from third party sites, so we can give you the most unbiased and accurate information possible.

Japan taxes crypto as income and has some of the most aggressive tax rates on cryptocurrencies globally, up to 55%. In some circumstances, earnings under 200k JPY are tax-free. Organizations are lobbying to have Japan treat crypto as capital gains, not regular income.

Japan also subjects corporations to a 30% tax on crypto holdings whether or not they’ve sold. New legislation is being passed that may change this rule.

Do you pay cryptocurrency taxes in Japan?

Yes, residents and non-permanent residents of Japan are taxed on cryptocurrency. The Japanese National Tax Association (NTA) views crypto as property and taxes it as miscellaneous income under the Payment Services Act (PSA) and the Financial Instruments and Exchange Act (FIEA).

Japanese taxpayers are not taxed when they purchase, hold, or move crypto between wallets. However, if you’ve purchased or sold crypto and made more than 200k JPY, you must declare your crypto gains on your income tax return.

You must also report all crypto received from mining, staking, interest, or airdrops. These are taxed in a similar fashion as profits from trading crypto.

What are the crypto tax rates in Japan?

Japan considers crypto earning over 200k JPY to be "miscellaneous income," which means they can be taxed at rates up to 55%. This includes permanent residents’ profits from cryptocurrency trading, Bitcoin mining, and DeFi lending. Japan taxes stock profits at a flat 20%, so its crypto tax rates are comparatively high.

Japan has a progressive tax on miscellaneous income, ranging from 5% to 45% on profits. Japanese taxpayers must also pay an inhabitant tax of 10% on profits, consisting of a prefectural and municipal rate of 4% and 6%. Therefore, the effective crypto taxes Japan rate is between 15% and 55%. Non-permanent residents of Japan pay a flat 20% tax on all income earned in Japan.

How is crypto taxed in Japan

The Japanese National Tax Association (NTA) views crypto as property and taxes it as miscellaneous income. All individual taxes are filed based on the previous year ending 31 December, and they need to be reported by 15 March of the next year. However, there are crypto tax extension options.

Japanese taxpayers must report all profits from crypto as well as crypto received from mining, staking, interest, or airdrops, which are taxed in a similar fashion as profits from trading crypto. The high tax on cryptocurrency has led many in Japan to underreport their earnings. In response, Japan has increased crypto tax investigations.

CoinDesk reports that according to the Asahi Shimbun, in 2019 roughly 50 individuals and 30 companies in Japan were found to have failed to declare crypto income from the past few years properly. Investigators focused particularly on entities that appeared to have made significant crypto gains, concluding that many had tried to conceal their total earnings.

For example, two companies attempted to hide crypto profit by transferring millions of yen of virtual currencies, billed as "consulting fees," only to return most of the cryptocurrency to the sender. The fees could then be written off, reducing the income tax amount.

Japan tried a crypto tax evader for the first time in 2021, sentencing him to a one-year prison sentence and a fine of over 22m JPY ($200k).

Japan crypto tax calculation

Income tax rates vary depending on your income tax bracket. You could owe significantly less than the 55% maximum tax rate on cryptocurrency gains. Here's one example:

Japan crypto tax calculation example one

You purchase 1 ETH for 200k JPY and later sell it for 300k JPY, a 100k JPY profit. This is your only miscellaneous income for the tax year.

You’ll pay no tax on this crypto profit, as you’ve earned less than 200k JPY from investments like crypto. You may not need to include these crypto profits as part of your annual income tax return.

If you file for a medical expense or a hometown tax deduction, you must file any profits.

And here is a second example:

Japan crypto tax calculation example two

You purchase 10 ETH for 2m JPY and later sell for 3m JPY, a 1m JPY profit.

You earned a total of 7m JPY during the tax year, so are subject to the 23% income tax rate in addition to the 10% local inhabitant’s flat tax rate, for a total rate of 33%. You’ll pay 333.33k JPY in taxes on the profits from your sale of ETH.

For more complex examples than those above, the NTA recognizes two cost-basis methods: the moving average method and the total average method. The default accounting method individual Japanese taxpayers should use is the total average method.

The moving average method is the same as the average cost basis method. This method is simple and takes into consideration the total cost for all assets of the same type in possession and uses this to find the average cost of each unit. Cost basis is determined from the average unit cost.

The total average method is similar to the moving average method, with a special rule that separates them: the cost basis calculated for the disposal of any asset according to the total average method must consider the total acquisition cost of all units of the same type during the entire financial year, whereas the moving average method only considers the acquisition cost of the actual holdings at the time of disposal.

When in doubt, TokenTax and our experts can assist with all your crypto tax calculations, however complex.

Schedule a FREE crypto tax consultation

Japan crypto taxes for professional traders

Whether you trade crypto casually or professionally, Japan applies the same level of taxation on your crypto profits, treating them as income. The amount you’ll owe will depend on your total level of income and whether you’re a full-time or temporary resident.

Income tax brackets in Japan

Below are the income tax brackets and corresponding tax rates on your cryptocurrency, not including the 10% local inhabitant’s flat tax rate.

| Tax Bracket (JPY) | Income Tax Rate |

|---|---|

| Less than 1.95m | 5% |

| 1.95-3.3m | 10% |

| 3.3-6.95m | 20% |

| 6.95-9m | 23% |

| 9-18m | 33% |

| 18-40m | 40% |

| 40m and above | 45% |

How do you report crypto tax in Japan

In Japan all income or gains from crypto is taxed and must be reported in your annual tax return per the official Tax Answer No.1524 released by NTA. All income tax returns in Japan must be filed individually - there are no joint tax returns allowed. The deadline is March 15, following the calendar tax year.

If your income as a Japanese taxpayer consists only of employment income by a single local employer and does not exceed JPY 20 million in the tax year, you will simply make a so-called "year-end adjustment" on the employment income. Japanese taxpayers who are employees will receive a Gensen-Choshu-Hyo, the official employer tax form. It outlines your earnings and the amount of taxes you paid in the calendar year.

If your total income other than employment income (including proceeds from crypto) is 200k JPY or less, you are not required to file an income tax return.

Japan crypto tax filing forms at a glance

There are two types of income tax filing forms in Japan:

Form A: for those who only have employment income, miscellaneous income such as pensions, dividend income or occasional income, and do not have any estimated tax prepayment.

Form B: for anyone regardless of the type of income.

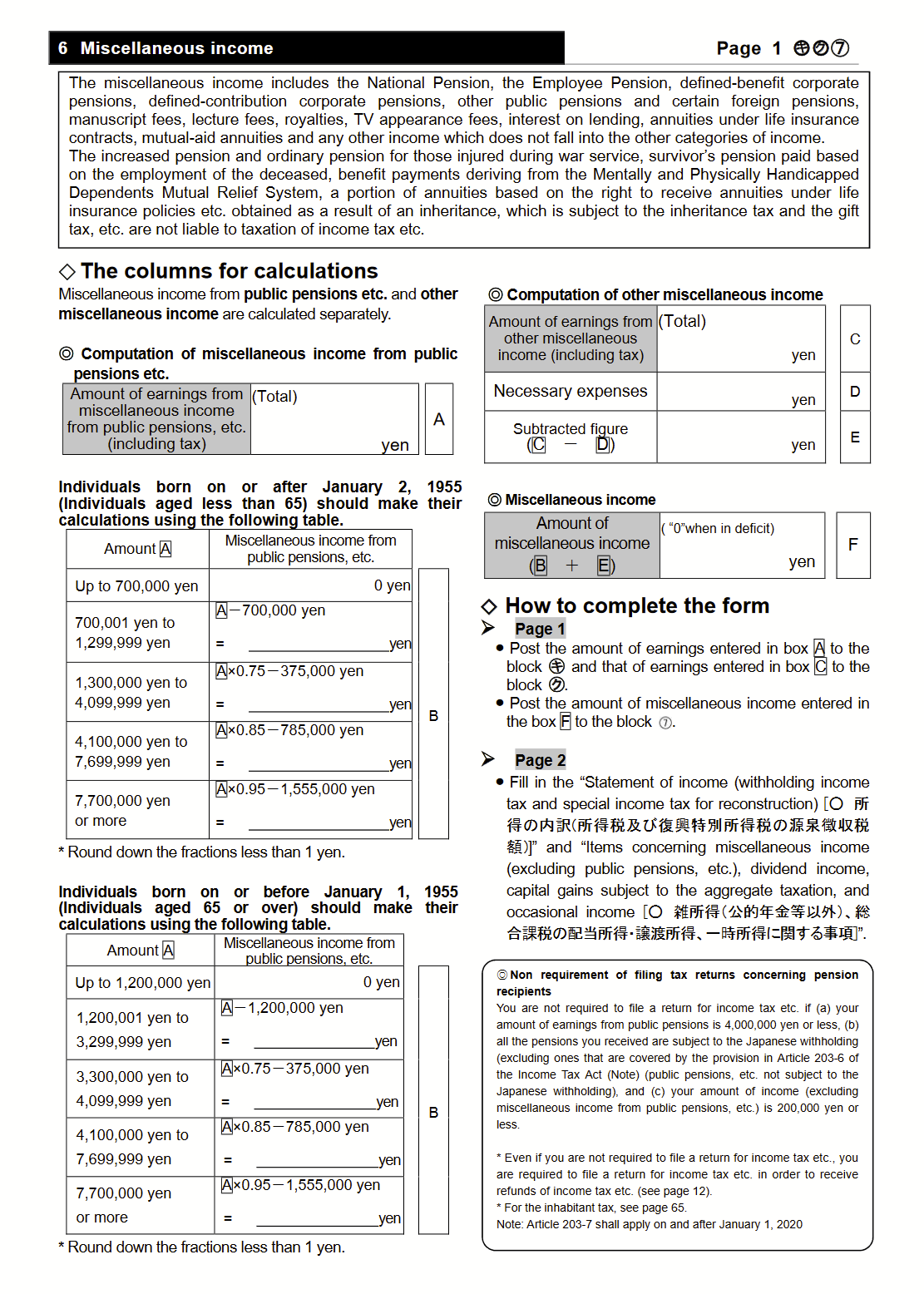

Japanese taxpayers must report crypto profits in Section 6 (for miscellaneous income) of the standard income tax filing form, with instructions on completing it from the NTA below.

Long-term crypto trades

Whether you hold crypto short- or long-term will not affect your Japan crypto tax consequences, at time of writing. You are also not presently able to offset losses incurred from crypto trades year over year.

Crypto mining, staking, and lending

As noted, Japan considers crypto earning over 200k JPY to be "miscellaneous income.” All income earned from mining, staking, or lending cryptocurrency Japan taxes as miscellaneous income, which means the market value of the received cryptocurrency at the time of acquisition is the amount subject to taxation.

You may, however, deduct expenses incurred in the acquisition process. Note if you declare deductions, you will be subject to tax even if you earned less than 200k JPY.

Crypto as payment for goods and services

If you use crypto to pay for goods and services, it triggers a taxable event and you need to track profits and losses as you would if you exchanged your crypto for fiat or other crypto.

In Japan cryptocurrency transactions are not subject to consumption taxes. This means if you use crypto for payment at a brick-and-mortar store, the transaction may not be required to pay sales taxes.

Utility tokens

As with every other type of crypto in Japan, gains from utility tokens are treated as “miscellaneous income” and taxed accordingly. It’s important to keep a good record of all your crypto activities, including DeFi, and properly declare any and all gains from crypto.

Tips to minimize crypto taxes in Japan

The simplest way to minimize your crypto tax obligations in Japan is to hold and sell in a low-income year. Beyond that, because Japan taxes crypto as income, there’s little to be done to reduce your tax obligation, and avoidance can have serious consequences.

At time of writing, you cannot offset losses year over year, so that strategy will not work for Japanese taxpayers. That noted, you could strategically attempt to keep your crypto earnings under the 200k JPY tax threshold year over year, which would reduce your tax obligation. Note that if you declare deductions on your income taxes, you will be subject to tax even if you earned less than 200k JPY miscellaneous income.

Crypto taxes calculators or software to help calculate Japan crypto taxes

If you need assistance to calculate your Japan crypto taxes, consider TokenTax. TokenTax is both a complete crypto tax calculation software platform and a full-service crypto tax accounting firm.

With TokenTax, when it’s time to calculate your Japan crypto taxes, you can simply import data from every crypto exchange, blockchain, protocol, and wallet and sync your transactions via API or upload them in a supported CSV format.

At TokenTax, our mission is to remove any and all challenges from your crypto tax Japan filing and guarantee accuracy and thoroughness. Should you have questions or doubts about your Japan crypto taxes, our experts will be glad to help.

Crypto taxes for businesses

At time of writing, Japanese firms are required to pay a set 30% corporate tax rate on holdings even if they haven’t realized a profit through a sale. Because of this, many blockchain firms have moved elsewhere.

In order to attract crypto business back to Japan, the ruling party recently (December, 2022) met and approved a proposal to remove the requirement for crypto companies to pay taxes on paper gains from tokens that they have issued and held.

Accordingly, cryptocurrency issuers in Japan are now exempt from the 30% corporate tax on unrealized gains from tokens.

All Japanese businesses that deal with cryptocurrency must use the moving average method to calculate profits and losses.

Frequently asked questions

Here are some common answers to frequently asked questions around crypto taxes in Japan.

When will you pay tax on crypto in Japan?

Taxes are due on the tax deadline of March 15. You may be able to apply for an extension.

When is the tax deadline in Japan?

The Japanese tax deadline is March 15, following the calendar tax year.

What happens if I don't file my cryptocurrency taxes in Japan?

If you fail to file your crypto taxes in Japan, you may be subject to fines or serious legal consequences. Japan tried a crypto tax evader for the first time in 2021, sentencing him to a one-year prison sentence and a fine of over 22m JPY ($200k).

Is cryptocurrency legal in Japan?

Yes, cryptocurrency is legal in Japan and treated as property.

How are crypto as wages taxed in Japan?

Crypto wages are taxed as regular income in Japan.

Where can I find the cryptocurrency regulation for Japan?

The NTA regulates cryptocurrency in Japan. Tax Answer No.1524 addresses questions concerning crypto.

To stay up to date on the latest, follow TokenTax on Twitter @tokentax.