Everything You Need to Know About Crypto 1099s in 2024

TokenTax content follows strict guidelines for editorial accuracy and integrity. We do not accept money from third party sites, so we can give you the most unbiased and accurate information possible.

1099 Forms are a series of documents the IRS refers to as "information returns.” Depending on the nature of your crypto activity and the exchange(s) you use, you may receive one or more 1099 crypto forms.

Regardless of whether you receive a Form 1099 for crypto from an exchange, you need to report the details of all crypto earnings on your tax returns.

Do I have to report crypto on my taxes?

In short, yes, you must report crypto in your annual tax filing. Per the IRS, US-based crypto holders must report earnings, gains and losses from crypto in your taxes.

In November 2021 the US House of Representatives passed the Infrastructure Bill, which included more stringent regulations on tax reporting for crypto exchanges. Beginning in the tax year 2023, US-based crypto exchanges must collect tax reporting information from their customers so that they can send them (and the IRS) 1099 crypto forms. [1]

1099 tax forms report income earned from an entity or person other than an employer. There are 20 types of 1099 forms, but the bill does not specify which type must be issued by exchanges, although the information the bill requires resembles what is collected by the 1099-B.

As of the 2022 tax year, the US-based cryptocurrency exchanges that send cryptocurrency 1099s typically send one (or more) of the three types of forms detailed below.

What is Form 1099?

1099 Forms are a series of documents the IRS refers to as "information returns,” and include a variety of forms that report different types of payments you might receive throughout the year other than from what a business might pay you as an employee. This could be a freelance job, gig work, rent payments for landlords, or income from crypto activity.

1099 Forms are issued to anyone who earned more than $600 from this secondary income source during the tax year. We’ll cover 1099 Forms as they pertain to crypto in this article.

How do I get a cryptocurrency 1099 form?

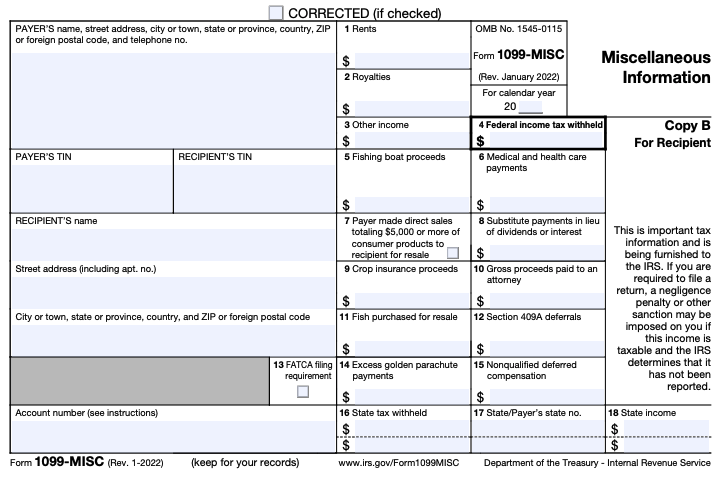

Crypto exchanges may issue Form 1099-MISC when customers earn at least $600 of income through their platform during the tax year. Typically you’ll receive this form by January 31, and crypto income reflected on these forms is usually reported as “Other Income” on Form 1099-MISC.

What is Form 1099-MISC?

As its name suggests, Form 1099-MISC is designed for reporting miscellaneous ordinary income to the IRS. Before the 2020 tax year, it was most often used for reporting non-employee compensation.

However, some crypto exchanges have begun to use this crypto 1099 to report traders’ gross income from crypto rewards or staking. This amount is typically reported in Box 3 of Form 1099-MISC, as “other income.”

For more information on Form 1099-MISC, see our article: Does Coinbase Report to the IRS?

Which exchanges send Form 1099-MISC?

Here are some exchanges and brokers that send Form 1099-Misc. Always check with your individual exchange for their current policies around crypto 1099 forms.

Bitstamp Earn

BlockFi

eToro

Gemini Earn

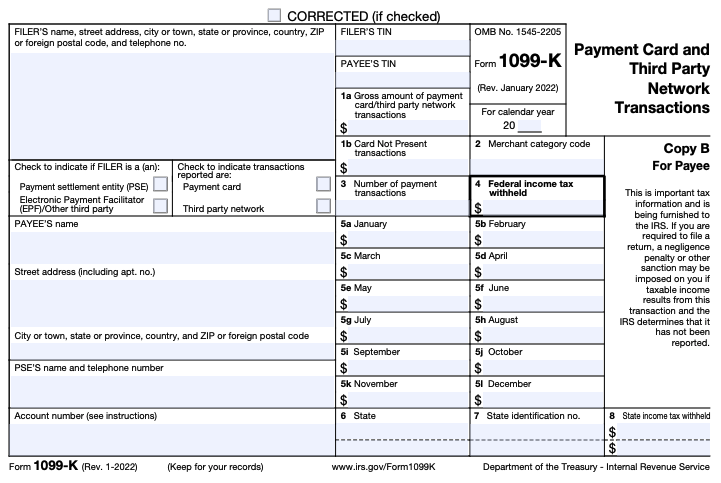

What is Form 1099-K?

The Form 1099-K states your cumulative amount traded in a tax year - that is, the total value of crypto that you have bought, sold, or traded on an exchange. This form is also known as a Payment Card and Third-Party Network Transactions Form. This crypto 1099 is commonly used by credit card companies and payment processors like PayPal to report payment transactions they’ve processed for third parties.

Exchanges that send Form 1099-K typically send it to US traders who have made 200 or more transactions, the volume of which equals $20,000 or more. The American Rescue Plan of 2021 lowered this threshold to $600 but the IRS has delayed it.

As a result, third-party organizations are not required to report tax year 2022 transactions on a Form 1099-K to the IRS or the payee for the $600 threshold. For the 2022 and 2023 tax years, some states followed the $600 requirement.

Concerning the 2024 tax year, per the IRS: "Following feedback from taxpayers, tax professionals, and payment processors and to reduce taxpayer confusion, the Internal Revenue Service delayed the new $600 Form 1099-K reporting threshold requirement for third party payment organizations for the tax year 2023 and is planning a threshold of $5,000 for 2024 to phase in the new law."

Note that the amount on the 1099-K does not represent your total capital gain or loss, and you don’t need to include the amounts on this document in your tax return. Do not be alarmed if the number on your 1099-K is larger than you’d expect. This is merely a report of your trading volume to the IRS. If you trade often, you may have a very large trading volume while not having a large gain or loss.

Which exchanges send Form 1099-K?

Here are some of the exchanges and brokers that send form 1099-K. Always check with your individual exchange for their current policies around crypto 1099 forms.

Bitstamp

Cash App

Crypto.com

eToro

Gemini

Venmo

What do I need to do on my crypto taxes if I get a Form 1099-K?

As is the case for many crypto tax forms, if you’ve received a Form 1099-K, so has the IRS. The form alerts the IRS that you have been trading cryptocurrency and thus you will likely be expected to report crypto on your tax return.

The 1099-K doesn’t report individual transactions, just the cumulative amount traded. You will need to report each transaction—as well as any other crypto transactions from any exchange—in order to calculate your crypto taxes. If you fail to file, you may be audited by the IRS.

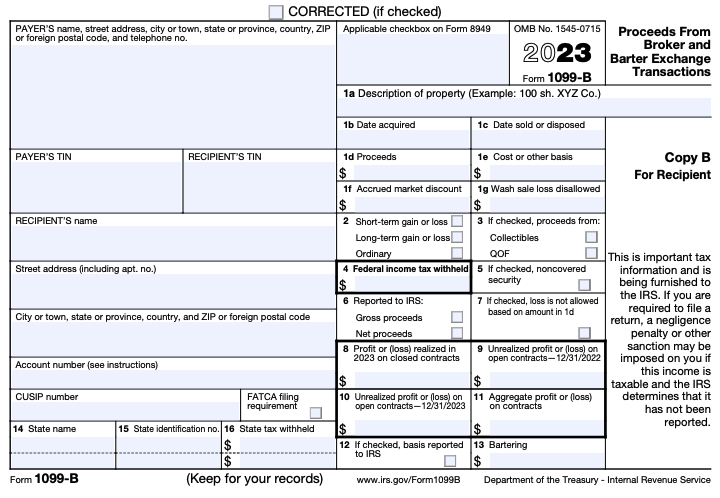

What is Form 1099-B?

Form 1099-B is traditionally used by brokers and barter exchanges to report gains on a capital asset sold or exchanged on behalf of clients. Unlike Forms 1099-MISC or 1099-K, Form 1099-B does report individual transactions, detailing the following information:

A short description of the item sold, such as “10 BTC Sold”

The date it was acquired

The date it was sold

How much it was acquired for

How much it was sold for

Whether the broker withheld any federal tax

Each transaction is reported separately, although trades from the same brokerage may be consolidated.

Form 1099-B often presents challenges for crypto exchanges, however, since the decentralized, easily-transferable nature of crypto can make it difficult to calculate an asset’s cost basis information.

For example, a user might transfer crypto between wallets on two different exchanges and then ultimately sell the asset on the second exchange. Although the second exchange would know the amount the crypto sold for and the date it was sold, it wouldn’t know the same information about the crypto’s acquisition. Therefore, it would be unable to determine the gains or losses a trader made on the transaction. This is where a crypto tax calculator like ours at TokenTax can be a huge help for traders.

Which exchanges send Form 1099-Bs?

Here are some of the exchanges and brokers that send Form 1099-B. Always check with your individual exchange for their current policies around crypto 1099 forms.

BlockFi

Cash App

eToro USA

Robinhood

Uphold

What do I need to do on my crypto taxes if I get a Form 1099-B?

Individuals and/or their crypto tax professionals use Form 1099-B to fill out Form 8949, which is eventually filed on the taxpayer's Schedule D. Be aware, however, that because of the difficulties inherent in reporting crypto transactions, Forms 1099-B may often contain incorrect information. We recommend you speak to a crypto tax professional concerning how to proceed if you receive a 1099-B.

Does Coinbase issue Form 1099-B?

The short answer is no, Coinbase does not at time of writing issue form 1099-B for crypto trading. Currently, Coinbase issues 1099-MISC if you meet the following criteria:

You used Coinbase in the previous year

You are subjected to US taxes

You received $600 or more from transactions on Coinbase

This may be subject to change very soon. Because of the 2021 American Infrastructure Bill mentioned before, brokers like Coinbase may eventually be required to send 1099-B forms to report capital gains. It’s unclear when this will actually take effect, so for now expect to receive a 1099-MISC form from Coinbase.

How will mandatory 1099-B Forms impact tax reporting?

Any US-based crypto trading platform that is considered a broker may in the future need to provide 1099-B forms both to you and the IRS. These forms are already mandatory for stock brokers but can be tricky for reporting crypto earnings. At time of writing, it’s unclear if and when crypto exchanges will be forced to issue 1099-B Forms.

Because traders exchange crypto between exchanges, both centralized and decentralized, it is practically impossible for an exchange like Coinbase to give an accurate report to the IRS for all its users. It is simply too complex for exchanges to provide many of their customers with accurate tax reporting information.

The bottom line for crypto holders is this: make sure to carefully track your transactions and report them properly and avoid future scrutiny by the IRS. When in doubt, TokenTax can help.

What is Form 1099-DA?

Form 1099-DA (Digital Assets) is an as-yet-unreleased form from the IRS specifically designed for cryptocurrency, but with much of the same information that you would find on a 1099-B. It was announced in response to the new reporting requirements, which go into effect for tax year 2023. Therefore, the 1099-DA should be available in 2024 for 2023 tax filing.[2]

There is speculation that with Form 1099-DA, crypto exchanges will not be expected to report cost basis. Rather the IRS may only require exchanges to report gross proceeds from crypto disposals within their platforms, placing the burden on the taxpayer to track the cost basis for all of their crypto and report their capital gains accurately.

For more info on crypto tax basics, visit our crypto tax guide.

What should I do if I see a different fair market value on my 1099 forms?

Crypto moves fast, and it’s famously easy to move crypto between exchanges and wallets. Sometimes the information you receive on your 1099 may not accurately reflect your records. Crypto is priced on several different markets, so the information may be taken from a different source than you have. If this happens to you, just go with the market value listed on your 1099 crypto form, since this is the information the IRS has.

Again, it’s essential to keep an accurate record of your transactions and ensure your annual tax filing accounts for all your crypto activity in case you should ever be audited by the IRS. TokenTax makes this process simple and ensures your crypto filing is thorough and accurate, each and every year.

How do I report transactions on Form 1099 on my tax return?

1099 crypto forms are issued based on the amount of income and the type of transaction. For example, if you received $600 or more in cryptocurrency from Coinbase Earn, USDC rewards, and/or staking, for example, Coinbase will send you a 1099-MISC Form.

To report crypto tax activity, use Form 1040-B (Schedule D) to reconcile your capital gains and losses and Form 8949 if necessary. Taxpayers must report their total capital gains or losses on your Form 1040, line 7. Forms 1099-NEC (Schedule C) or 1099-MISC (Schedule 1) may be used in relation to ordinary earned income related to cryptocurrency activities.

The most important thing to keep in mind while reporting transactions is honesty and thoroughness. The IRS will receive your information from trading platforms and third-party networks. Tax evasion is a serious crime, so report truthfully. Our team at TokenTax is available to support all your crypto tax filing needs.

What do I do if I receive a Form 1099-MISC that doesn’t match my records?

If you receive a Form 1099-MISC that doesn’t match your records, it's important to address the discrepancy promptly to ensure your tax obligations are accurately met. Here’s what you should do:

Review Your Records: Double-check your own records and compare them with the income reported on the Form 1099-MISC. Make sure to account for all payments and their corresponding dates to verify the accuracy of your documentation.

Contact the Payer: If you find any discrepancies, reach out to the payer directly to clarify the error. It's possible that a simple misunderstanding or clerical error caused the incorrect reporting.

Request a Corrected Form 1099-MISC: If the payer acknowledges the error, request that they issue a corrected Form 1099-MISC. The corrected form will include a special box checked to indicate that it is amending a previously issued 1099-MISC, which helps ensure the IRS does not double-count your income.

Keep Documentation: Maintain copies of correspondence with the payer regarding the discrepancy and the corrected form. This documentation may be essential if you need to explain the situation to the IRS or during an audit.

Report Accurately on Your Tax Return: If the corrected Form 1099-MISC is not available by the time you file your taxes, report the income you received. Attach a statement to your return explaining the discrepancy and the steps you've taken to resolve it.

Consult a Tax Professional: If you're unsure how to handle the discrepancy or if the payer refuses to issue a corrected form, it may be wise to consult with a crypto tax professional like ours at TokenTax.

Crypto 1099 FAQs

Here are answers to some frequently asked questions about 1099 crypto forms.

Do you get a 1099 for cryptocurrency?

Whether you receive a 1099 for crypto will depend on the platform(s) you use and your activity in crypto for a given tax year. Different platforms provide different forms. You will most likely receive a 1099-MISC or a 1099-B. If you do not receive either of these forms, you still need to report all income on your tax return.

Do you need to report crypto 1099?

Yes, you must report your crypto 1099 income and include that in your tax return along with the rest of your crypto activity.

How much crypto do you have to sell to get a 1099?

Per the IRS “You must report income, gain, or loss from all taxable transactions involving virtual currency on your Federal income tax return for the taxable year of the transaction, regardless of the amount or whether you receive a payee statement or information return.” You will typically only receive a 1099 form if you meet the threshold of $600 or more in earnings.

What form do I need to report cryptocurrency on taxes?

Claim all crypto capital gains and losses on Form 8949 and Form Schedule D. Include ordinary crypto taxable income on the 1040 Schedule 1 or Schedule C if your earnings come from self-employment. If you are a US taxpayer, you need to attach each of these forms to your Individual Income Tax Return Form 1040. See our helpful article on how to report your crypto taxes for more information.

Do you get a 1099 for crypto from Coinbase?

Currently, US Coinbase users will receive a 1099-MISC form if they saw $600 or more in miscellaneous income such as rewards or fees from Learning rewards, USDC Rewards, and/or staking.

Do I need to report cryptocurrency earnings if I'm an independent contractor?

Yes, as an independent contractor, you are required to report all income, including earnings from cryptocurrency, on your tax return. This includes any payments received in the form of cryptocurrency, which must be reported as part of your total income.

When should I expect to receive a Form 1099 for my cryptocurrency earnings?

You should expect to receive a Form 1099 from the entity that paid you in cryptocurrency if your earnings meet or exceed $600 during the tax year. This form will typically be sent to you by January 31 of the following year, and you will need to report the income reflected on this form on your tax return.

What should I do if I haven't received a Form 1099 for my cryptocurrency earnings?

If you have not received a Form 1099 for your cryptocurrency earnings, you are still required to report this income on your tax return. Keep complete records of earnings and when in doubt consult with a crypto tax professional to ensure you are correctly reporting your cryptocurrency income.

To stay up to date on the latest, follow TokenTax on Twitter @tokentax.

Related Content

References

Last reviewed by Tynisa (Ty) Gaines,EA on April 12, 2024 · Sources